By Jon McKinney

President & Portfolio Manager

A letter from the President:

What is Your Purpose?

Every year at about this time, people – like me – sit down and write out their goals for the year in areas like family, health, and work. People want to know their purpose. They want to know why they get up in the morning.

I am 63 and I work full-time as a Portfolio Manager for ZLC Wealth. My job is to help clients build their wealth. So why do I do it? Well of course I do it for pay, but even if I didn’t need the pay (I do!), I would still do it because I love it. Not always – there are bad days and bad months – but I enjoy meeting clients and I thrive on market activity and the ever-changing challenge of assessing asset values. Plus, working at ZLC Wealth gives me purpose, and I’m told that having “purpose” is a key to living a long and healthy life.

In an interview with Diane Sawyers discussing advice on life to his kids, theoretical physicist Stephen Hawking put it this way:

“One, remember to look up at the stars and not down at your feet. Two, never give up work. Work gives you meaning, and purpose and life is empty without it. Three, if you are lucky enough to find love, remember it is rare and don’t throw it away.1”

Longevity experts Peter Attia and Bill Gifford, in a book I highly recommend, “Outlive, The Science and Art of Longevity” tell us we need to move past what they call “medicine 2.0”, our current system that cares for specific maladies, and move to “medicine 3.0” that addresses our health long before conditions become diseases. Attia calls heart disease, cancer, neurogenerative disease and type 2 diabetes the four horsemen. These are the four main impediments to achieving long healthy lives. We never know what lies ahead and despite our genetics and, I suppose, bad luck, we can still take steps to be the best we can.

Having purpose is part of that.

Harold’s Purpose

More than 75 years ago Harold Zlotnik had a purpose.

He founded a firm dedicated to building relationships with clients and earning their confidence through the delivery of high-quality services and products using the expertise of our associates and staff. The name has changed – from Zlotnik Lamb and Company to ZLC – and a portfolio management firm was created – ZLC Wealth – but the focus has never changed. ZLC still builds relationships, and our primary goal is to earn the confidence of our clients.

It’s our purpose.

At ZLC Wealth, we work with clients who are early in their investment lives – saving for home purchases – and clients who are later in their investment lives – living off their accumulated capital and structuring their estates for the next generation. Many of our clients, especially the more “mature” ones, are also sharing some of their wealth by supporting charitable causes. For these clients, giving back is part of their purpose. Giving back and charitable work is among the most valued pillars of our organization, and our advisors and staff support many charities. We also have a long history of helping clients with their specific charitable giving.

Why Do We Give?

The world’s most charitable billionaire, Warren Buffett, who has donated close to US$55 Billion to registered charities and continues to commit more every year2, once said:

“If you find yourself in the most fortunate one percent of humanity, it’s your responsibility to consider the well-being of the remaining 99 percent.3“

Contributions to charitable causes not only enable individuals to make a positive impact in their communities but they also come with significant tax advantages for donors. At the federal level, individuals receive a 15% tax credit for the initial $200 donated and an additional 29% for any extra contributions, plus provincial credits4. For corporations, CRA permits dollar-for-dollar tax deductions on donations to qualifying organizations, including private foundations5. The deduction can go up to a maximum of 75% of the corporation’s net income. There is a significant planning aspect to giving.

The ZLC Foundation

In 1995, ZLC Financial, our parent company, started the ZLC Foundation as a way to help our clients give. The ZLC Foundation is a public foundation registered with the Canada Revenue Agency and it provides clients with a one-stop solution to easily integrate charitable giving into their financial plans. ZLC provides all the required professional, administrative and concierge services.

Assets held by the ZLC Foundation are managed by us, the ZLC Wealth portfolio managers. ZLC Wealth helps boost the value of our clients’ charitable contributions through active investment management and oversight, and we can tailor the approach to donors’ specific needs. The ZLC Foundation team efficiently manages all administrative tasks essential for effective donation plans. Every account is donor-directed, granting donors the discretion to choose the organizations they wish to support.

The ZLC Foundation serves as a conduit, connecting generous donors with the causes they hold dear. Philanthropists require a strategic approach to charitable giving and a long-term, multi-generational wealth management plan to transform their vision into their legacy.

Opening a ZLC Foundation account is as simple as opening an RRSP. If you have a cause close to your heart and are enthusiastic about incorporating charitable giving into your “purpose”, contact us for a full discussion of our services and the applicable ZLC Foundation and ZLC Wealth fees.

Looking Back: 2023 in Review

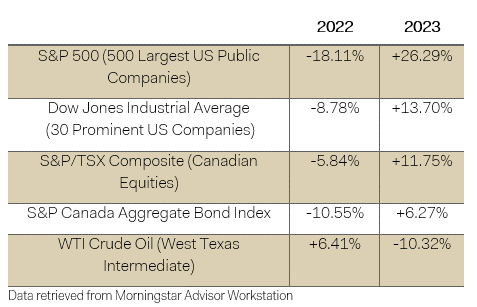

Coming after the challenges of 2022 where all major asset classes except oil dropped, things turned around nicely in 2023.

Attractive asset prices and greater optimism about dropping inflation, together with economic growth, spurred a market rally. By June 2023, the S&P 500 had already hit double digit returns6.

The technology, communications and consumer goods sectors all made a strong comeback in 2023, recouping their 2022 declines and posting substantial gains by year end.7 The technology heavy Nasdaq Composite Index saw one of its best years ever. After a 33% plunge in 2022, the Nasdaq Composite finished 2023 with a 43% return.8 The standout performance was driven by the success of the “Magnificent Seven” – Apple, Alphabet (Google), Meta Platforms (Facebook), Amazon, Tesla, Nvidia, and Microsoft – the seven biggest tech companies in the United States. This group is collectively known as “The Magnificent Seven”, and rightfully so. Their market success made up most of the gains in the S&P 500 and the Nasdaq.

Inflation and Interest Rates

In the response to continuously stubborn inflation that persisted through 2022 into 2023, the US Federal Reserve continued their campaign of policy tightening, raising their key policy interest rate another 1% between November 2022 and June 2023, bringing their key policy interest rate to 5.5%. Their goal: to move inflation back to its target of 2-3%.9

This continued trend of policy tightening hit interest-rate-sensitive industries hard, most including the banking industry. In the initial weeks of 2023, a wave of regional banks, notably Silicon Valley Bank, First Republic, and Signature Bank, collapsed. This occurred due to substantial losses from the swift liquidation of bond and commercial real estate portfolios.10 The ensuing panic left these banks unable to meet the demands of depositors, resulting in a “run on the bank” and culminating in the Federal Deposit Insurance Corporation (FDIC) seizing control of the bank activities, averting a full-blown banking crisis.

Reasons for Optimism

In June 2022, inflation surged to an almost 40-year high of 8.1%. Since then, Canada’s recovery, marred by many challenges, is displaying positive signs. The latest data from Statistics Canada indicates that the country’s inflation rate currently stands at an annualized rate of 3.4%.11 This substantial reduction is indicative of short-term successes linked to the Bank of Canada’s tightened monetary policy, complemented by contributing factors like a decline in energy prices and stabilized housing costs (rent and mortgages).

Despite the challenges of the past 18 months, the economy has successfully avoided a recession. Looking ahead to 2024, many economists now project that instead of a full-blown recession, there is a likelihood of experiencing a period of economic slowdown.12 This perspective suggests the possibility of a gradual relief from the steep rises in the cost of living and the high servicing costs on debt.

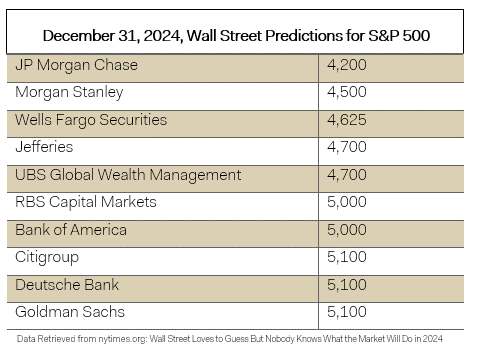

The table below shows the predictions by 10 of the biggest banks for the year-end target for S&P 500 index for 2024. As of this writing, the index is around 4750, so the predictions range from plus 9% to minus 9%.13 That’s helpful! Actually, its not helpful at all and it is why we approach our task, investing your money, without trying to guess the future.

ZLC Wealth Portfolios

As we bid farewell to 2023, ZLC Wealth is happy to share the remarkable performance of our portfolios throughout the year.

Our investment strategies, deeply rooted in our core values, delivered impressive returns across the spectrum. From our Conservative to our Maximum Growth mandates, we consistently outpaced our benchmarks by an average of 0.5%, underscoring the strength of our approach.

A standout contributor to our portfolio success is EdgePoint Wealth, our Canadian Equity manager. Their Canadian Portfolio returned over 20% in 202314. Notably featured as a presenter at our October 2023 Annual Client Update, EdgePoint exemplifies excellence in both performance and alignment with our investment principles. Their deliberate inclusion of small and medium companies offers our clients the benefit of true active management, an invaluable attribute missed by most managers and absent in passive index funds.

In constructing our portfolios, we also prioritize alternative strategies that have low correlations to the overall markets. This approach enhances diversification, ensuring all-weather performance. Alternative strategies align with institutional trends, an approach used by Canada Pension Plan, and underscores our commitment to a pension-style management process, a fundamental pillar of our success.

While we evaluate our partners’ performance, our lens remains broad, always prioritizing the future growth of our portfolios. A hallmark virtue is our independence and our ability to select managers from entire universe of investments, enabling strategic and tactical decisions made in the best interest of our clients. This independence is foundational to our commitment to delivering optimal outcomes for those who entrust us with their financial well-being.

Admin Updates:

2023 RRSP

Don’t pay more tax than you need to! Your 2023 RRSP contributions are due by February 29, 2024 (it’s a leap year). The annual limit for 2023 is the lesser of $30,780 and 18% of your 2022 “earned income”, plus any unused deduction room from prior years. The amount available from prior years is shown on your 2022 Canada Revenue Agency (CRA) Notice of Assessment or the “My Account” feature on the CRA website.

TFSA Contributions

The Tax-Free Savings Account (TFSA) annual contribution limit is now $7,000 (it was $6,500 last year). This means your lifetime contribution room is now at $95,000 (subject to age and residency conditions). Your available TFSA contribution room can be determined using the “My Account” feature on the CRA website.

A TFSA is a “must have” for investors. If you don’t have one, we can help!

Designating a Trusted Contact Person (TCP)

As your Portfolio Manager, ensuring the flawless management of every aspect of your account is our responsibility. While we operate as discretionary portfolio managers empowered to make specific investment decisions on your behalf, there may be instances where contacting you directly is required.

To address situations where direct contact is necessary and we are unable to reach you, we strongly encourage our clients to designate a Trusted Contact Person.

This individual is someone you authorize us to contact on your behalf in the event that direct communication with you is not possible.

Designating a Trusted Contact Person is like designating an emergency contact. The designation of a TCP is a prudent step for any client with any type of investment account. It is particularly recommended for those over 65.

Designating an individual as a TCP does not make them your power of attorney, legal guardian, trustee or executor. You can be confident that a TCP is limited in what they can do on your behalf.

A TCP cannot:

- Request trades on your behalf

- Request deposits or withdrawals

- Request information about your account such as your balance, contributions, transactions or returns.

Speak with us today about designating a TCP on your account.

Have You Tried Piersight?

Our team remains focused on your investment performance, but we are also working on streamlining and enhancing client engagement and improving the privacy and safety of your personal information. Piersight is our online client portal. It lets you access your account holdings and quarterly statements at any time. All information is stored securely and is accessible 24/7.

For added security, Piersight uses 2-Factor Authentication or 2FA for logon. Initially the 2FA login was done through an App called Authy, but now to make it easier you have a choice of the Google or Microsoft Authenticator Apps.

If you haven’t yet signed up or would like assistance logging in to view your account, please contact us at wealthinfo@zlc.net and we will be happy to assist you.

Have a happy, healthy and prosperous new year. May your 2024 have purpose!

- The ZLC Wealth Team

From Left to Right:

- Vilayphone (Violet) Smith CPA, CGA, CFP, CLU, CHS, TEP, FEA, Associate, Integrated Financial Planning

- Mark van Koll CPA, CGA, FCSI, CAMS, Chief Compliance Officer

- Grace Domingo Vice President Administration

- Jon McKinney CPA, CA, CIM®, President & Portfolio Manager

- Garry Zlotnik FCPA, FCA, CFP, CLU, ChFC, Chief Executive Officer & Portfolio Manager

- Tom Suggitt CFA, CIPM, CFP, FCSI, Vice President, Portfolio Manager & Head of Investment Oversight Committee

- Lisa Der Senior Account Manager

- Michelle Richier CPA, CA, Chief Financial Officer

Disclaimer

DISCLAIMER: This newsletter is solely the work of the author for the purpose to provide information only. Although the author is a registered Investment as a Portfolio Manager at ZLC Wealth Inc. (ZLCWI), this is not an official publication of ZLCWI. The views (including any recommendations) expressed in this newsletter are those of the author alone, and are not necessarily those of ZLC Wealth Inc. The information contained in this newsletter is drawn from sources believed to be reliable, but the accuracy and completeness of the information is not guaranteed, nor in providing it does the author or ZLCWI assume any liability. This information is not to be construed as investment advice. Your own circumstances have been considered properly and that action is taken on the latest available information. This newsletter is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This information is given as of the date appearing on this newsletter, and neither the author nor ZLCWI assume any obligation to update the information or advise on further developments relating to information provided herein. This newsletter is intended for distribution in those jurisdictions where both the author and ZLCWI are registered to do business. Any distribution or dissemination of this newsletter in any other jurisdictions is prohibited. The rate of return shown is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of the Fund or returns on investment in the Fund. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the offering memorandum or prospectus of the Fund before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Performance results are not guaranteed, values may change frequently, and past performance may not be repeated.

IMPORTANT INFORMATION: The above commentary may contain an update on certain funds offered through ZLC Wealth Inc. Returns are net of fees and include reinvested dividends. The performance of the fund presented in this document may be for a different series of fund than the series that you hold in your account. The performance of the series that you hold may be different than what is shown. This information does not constitute an offer or solicitation to anyone in any jurisdiction in which such an offer or solicitation is not authorized, or to any person to whom it is unlawful to make such an offer or solicitation. These products may not be appropriate for all investors. Important information about the funds is contained in the offering documents which should be read carefully before investing. You can obtain these documents from ZLC Wealth Inc. Please speak to a ZLC Wealth Portfolio Manager or Representative to determine if these products are right for you.

Sources:

1. Winsor, Morgan (March 14, 2018) The Most Important Pieces of Advice Stephen Hawking Gave to his Children

2.Liu, Phoebe (Oct 3, 2023) How Charitable Are The Richest Americans?

3. Schwantes, Marcel (Apr 23, 2018), Warren Buffett Gave This Brilliant Advice to Billionaires But It Can Instantly Improve Your Life Too.

4. TurboTax Canada (February 16, 2022) Tax Benefits of Charitable Donations

5. RBC Wealth Management (January 11, 2022) Charitable Donations Through your Corporation – RBC Wealth Management

6. Data retrieved from: Morningstar Advisor Workstation (Jan 10, 2024)

7.Lu, Marcus (January 5, 2024) Charted: S&P 500 Sector Performance in 2023

8. Google Finance (January 2, 2024) Nasdaq Composite Total Return Index

9. Tepper, Taylor (Oct 17, 2023) Federal Funds Rate History 1990 to 2023

10. Duggan, Wayne (Dec 4, 2023) 2023 Stock Market Year in Review

11. Statistics Canada (Jan 16, 2024) CPI, December 2023

12. Conerly, Bill (Dec 27, 2023) Economic Forecast For 2024: Recession Now Unlikely

13. Sommer, Jeff (Dec 23, 2023) Wall Street Loves to Guess But Nobody Knows What the Market Will Do in 2024

14. EdgePoint Wealth Management (Jan 10, 2024) EdgePoint Canadian Portfolio