Letter from the President:

We Climb the Wall of Worry

Happy 2022!

Are you fed up with Covid yet? I am. As I write this, we are seeing cases pile up in record numbers, Djokovic has been banned from defending his Australian Open title (his 9th!), and Quebec plans to tax the unvaccinated. Where do we go from here in life and in investing? Life is not my specialty, but I can opine on investing. Do what we recommend every year: STAY WITH YOUR PLAN. Pay attention to your risk level and diversify portfolio broadly both by asset class and by geography. This is the best advice we can give.

Of course, there are many reasons to be afraid. Covid has not gone away even though we are two years into it, inflation is at a 40 year high (it was this high in 1982) and the US market is above its 10-year average1. There is a Wall Street adage that is used when investors face negative news (like Covid and inflation): We “climb the wall of worry”. However, in my long life in the markets, there is another adage that always seems to make the most sense to me: when investing, focus on time in the market not timing the market. If you need cash, go to cash, but if you want to grow your investments, stay with your plan.

The Roaring 2020’s

If you want a book that may help you get past all the negative news we face today, pick up The Cloud Revolution: How the Convergence of New Technologies Will Unleash the Next Economic Boom and A Roaring 2020s (Encounter Books, 2021). The author is Mark P. Mills, a Senior Fellow at the Manhattan Institute and a Faculty Fellow at the McCormack School of Engineering and Applied Science at Northwestern University. Mills compares 2020 to 1920. 1920 was also the end of a major epidemic, the Spanish Flu, but it was the beginning of a period that brought big innovations in three key technological domains: information, materials and machines. The Spanish Flu preceded an extremely profitable period for investors with Dow Jones Industrial Average increasing by about four times from 1918 to 19282.

Mills makes the argument that we are going through the same sort of transition now, a transition that could be even more powerful. Of course, the 1920’s ended rather badly – market crash, depression and a major war – but it was also a time of great progress economically. Lifespan increased by 30 years and per capital wealth shot up 700 percent in that decade, and Mark argues the market crash, the great depression and the war were unrelated to the economic innovations that drove that growth.

Steve Forbes, editor-in-chief of Forbes Media, said of the book that it “Makes the exciting—and convincing—case that we’re on the cusp of a fantastic new era of technological breakthroughs that will vastly enrich our lives. What a timely—and much needed—antidote to the debilitating pessimism that now reigns.”

Our investment analyst, Gareth Langdon, walks us through the challenges and victories of 2021 and looks into what we might expect from 2022 in his commentary below.

– Jon McKinney, President and Portfolio Manager

FROM THE DESK OF GARETH LANGDON

Here we go again

For those of you, including myself, that expected a much more relaxed and normal 2021 after the chaos of 2020…we couldn’t have been more wrong! Thankfully, many of us were able to experience some of the activities and events that we were accustomed to pre-March 2020. Life in general was still disrupted by the pandemic and this was reflected in markets at times throughout the year which we will discuss. Despite some of the confusion over the past year because of the virus, inflation, supply chain issues, natural disasters, and many other challenges we all faced, equity markets overall kept trucking along and ended up giving back strong returns for investors, especially when looking at the main indexes which ended 2021 on a high note. Bond markets however had a rough year, while real estate soared.

Although economic growth and financial market returns for 2022 may not be as robust as what we experienced this past year because of extraordinary fiscal and monetary stimulus, that is not a reason or signal to abandon ship and cash out while ahead. The smart play over the long term is to continue being invested in a well-managed and diversified portfolio while looking to take advantage of any pullbacks in the markets. That is exactly what the Portfolio Managers at ZLC decided to do in November when the Omicron news was first making headlines and equity markets sold off on the reports and headlines from the details of the new variant. Since that dip in the equity markets, they have bounced back to either new all-time highs, or close to it.

Looking back

Over the course of the year, the TSX Composite had a total return of 25.09% while the S&P 500 (CAD) returned 27.61%, and the tech heavy Nasdaq Composite (USD) gained 22.18% respectively. Not all equity markets were that solid however, with the MSCI EAFE (CAD) gaining 10.82% and MSCI Emerging Markets Index (CAD) falling 3.37%. The Bloomberg Barclays Corporate Bond Index suffered a loss of 1.2%. This past year was massive for Bitcoin (and other crypto currencies) as it went more mainstream to finish up on the year 59.8%. 2021 gave us healthy market returns as the world was able to effectively distribute vaccines and consumers were able to spend some of the money they had built up during the worst of the pandemic. We also saw small pockets of market volatility but weathering the storm turned out to be the right decision. The unemployment rate in both Canada and the U.S. continued to decrease over the course of the year as many service sectors were able to reopen and consumers had the cash on hand to purchase new goods, even though it often took longer than expected for those online orders to show up at your door or at the nearest store.

Q4

Canada started the fourth quarter with a strong unemployment report showing jobs were back to pre-pandemic levels. The U.S. had weaker than expected results initially but overall has seen a drop in their unemployment rate as well. Over the last few months of the year economic data, in general, was strong. Near the end of October, the TSX Composite rose to an all-time high after extending its streak of gains for a 13th straight day – its longest run since 1985. The move was brought on by a surge in cyclicals and value stocks. The rise of the Omicron variant caused markets to sell off near the end of November as reported cases increased and the amount of uncertainty around the new variant was high. Since the initial scare, markets have been able to digest the situation and equity returns have bounced back. Fun fact: the S&P 500 closed at all-time highs 70 different times during 2021. Only 1995 had more all-time highs in a single calendar year.

For some asset classes, inflation can be beneficial and for others, it’s the opposite. In Canadian markets for example, we are better protected when it comes to inflation. The Bank of Montreal’s Chief Economist Douglas Porter explained this well in one of his notes mentioning “Canada’s big three sectors have little quarrel with inflation – energy and materials naturally fare well when commodities are in favour, while financials are benefitting from a steeper yield curve and the solid credit gains that underpin the inflation pressure”.

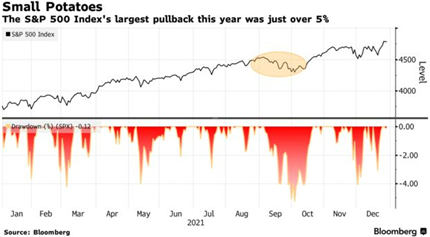

If we continue to see inflation stay above the magical 2% figure, having exposure to the Canadian markets should provide an imperfect hedge for investors. Looking at the situation in the U.S., The Federal Reserve had a very hawkish, or upbeat tone at their December meeting. The central bank signaled they expect to raise interest rates three times in 2022 to try and control inflation given the economy has made rapid progress toward maximum employment. Negative news seemed to have circulated nonstop over the past year, and at times it can be overwhelming when things look all loom and gloom. However, as the chart below depicts, the largest pullback in the S&P 500 was barely over 5%. It’s essential to keep the big picture in mind when we go through periods of negative returns or market corrections.

Energy Transition

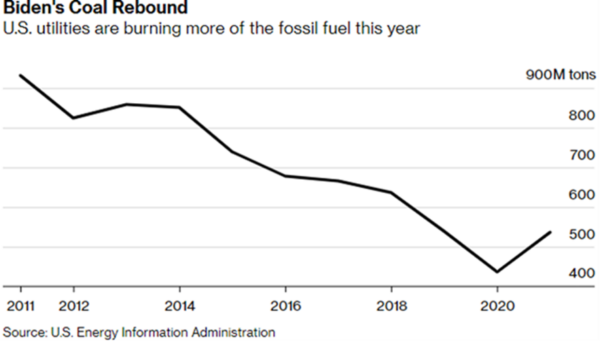

It wasn’t long ago when former President Donald Trump was in West Virginia at a rally, promising coal miners that he would revive their industry and bring back the jobs lost to the transition to cleaner energy sources. Ironically, it has been under Biden’s administration that coal has made a roaring comeback, at least in the short term.

A big theme this year was the conversation about making the global transition to more sustainable energy sources. As we all experienced, the onset of the pandemic put a temporary halt to pretty much everything in our lives as the world went to a virtual standstill. However, now that the world has emerged from that initial shutdown there is a strong need for power demand, just like there was before the pandemic began. One of the options available to meet demand, natural gas, is in short supply and wind/solar can be unreliable in certain regions around the globe to provide consistent electricity. This scenario has resulted in energy prices skyrocketing globally, albeit unequally with Asia and Europe feeling the crunch more so than North America. One resource that the world has been phasing out is coal, due to its negative environmental impact. However, at a time when energy is needed, coal has made a temporary comeback in 2021 to fill the void left from cleaner energy sources which need further investment and more infrastructure. For example, in the U.S., coal is expected to supply roughly 24% of electricity in 2021, after falling to 20% the year before which was a historic low. What this illustrates is that the transition to clean energy, although vital, will not be a smooth process without any hiccups and there still is a long way to go for the world to make the transition.

Bank of Canada

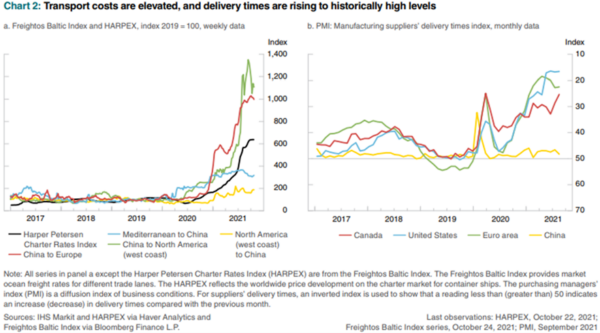

At the end of October, the Bank of Canada (BOC) released their last Monetary Policy Report for the year which highlighted some key points for investors to take note of. Just like many other central banks around the world, the BOC is mentioning how disruptions to global supply chains have intensified which has limited the production of certain goods leading to both higher costs and higher prices, as I am sure you experienced at some point this past year.

Despite the remarkable earnings we have recently seen, they will eventually peak if they haven’t already. In our last client letter we highlighted the substantial amount of savings in the economy, and clearly some of those savings have been put to use during the summer months as equity markets pushed higher on the back of these strong earnings results. We will be keeping a close eye to see how the next few earnings reports go and what that can tell us about the pace of growth in the economy and which industries continue to be robust.

Supply chains issues are expected to subside over the coming year, which should help to reduce some of the intense inflationary pressures we have seen recently. With that being said, the central bank mentioned in their report they expect inflation to stay above their control range for longer than they previously anticipated.

2022 Outlook

As we begin the New Year, we hope that the world can continue to overcome the challenges of Covid-19 and society can get back to a more normal environment, whenever that may be. Although the economic recovery we have seen in developed countries has been positive, it has also come with supply disruptions and inflation which has pushed up the prices in various products and services, putting pressure on central banks to raise interest rates to cool things down a little. Rate hikes are expected to begin this year by more central banks, but rates will most likely need to increase a fair amount to compete with equities. As always, the team at ZLC will watch leading economic and financial market indicators to see where things might be heading while keeping the big picture in mind and not overreact to short term noise.

I will leave you with what the team over at J.P. Morgan Global Research has determined the year might hold:

“2022 will be the year of a full global recovery, an end of the global pandemic and a return to normal conditions we had prior to the COVID-19 outbreak. We believe this will produce a strong cyclical recovery, a return of global mobility and strong growth in consumer and corporate spending, within the backdrop of still-easy monetary policy. For this reason, we remain positive on equities, commodities and emerging markets and negative on bonds.”

Their view is just one of many, and no one knows with certainty what financial markets, or the economy in general will look like over the next year. However, I would agree with their overall tone of optimism that there will be a continuation in the global recovery although I do expect there to be more volatility during the process. If the past two years have taught us anything, it is to expect the unexpected and have portfolios set up to do well in the long term over different economic conditions and not overreact when things don’t go according to plan in the short term.

Everyone at ZLC Wealth wishes you a Happy New Year and best wishes for 2022!

– Gareth Langdon

Sources:

1 RBC Wealth Management, Bloomberg; data as of 1/5/22

2https://www.macrotrends.net/1319/dow-jones-100-year-historical-chart (1918 Dow Jones Industrial Average low, 73.88, 1928 high, 300.00)

https://www.bnnbloomberg.ca/canadian-stocks-post-longest-rally-since-1985-as-cyclicals-boom-1.1670434

https://www.jpmorgan.com/insights/research/market-outlook-2022

https://www.bankofcanada.ca/2021/10/mpr-2021-10-27/

https://www.visualcapitalist.com/how-every-asset-class-currency-and-sp-500-sector-performed-in-2021/

https://economics.bmo.com/en/publications/detail/7dc1fda4-d96b-4469-a72c-757ad91edfc6/

DISCLAIMER: This newsletter is solely the work of the author for the purpose to provide information only. Although the author is a registered Investment as a Portfolio Manager at ZLC Wealth Inc. (ZLCWI), this is not an official publication of ZLCWI. The views (including any recommendations) expressed in this newsletter are those of the author alone, and are not necessarily those of ZLC Wealth Inc. The information contained in this newsletter is drawn from sources believed to be reliable, but the accuracy and completeness of the information is not guaranteed, nor in providing it does the author or ZLCWI assume any liability. This information is not to be construed as investment advice. Your own circumstances have been considered properly and that action is taken on the latest available information. This newsletter is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This information is given as of the date appearing on this newsletter, and neither the author nor ZLCWI assume any obligation to update the information or advise on further developments relating to information provided herein. This newsletter is intended for distribution in those jurisdictions where both the author and ZLCWI are registered to do business. Any distribution or dissemination of this newsletter in any other jurisdictions is prohibited. The rate of return shown is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of the Fund or returns on investment in the Fund. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the offering memorandum or prospectus of the Fund before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Performance results are not guaranteed, values may change frequently, and past performance may not be repeated.

IMPORTANT INFORMATION: The above commentary may contain an update on certain funds offered through ZLC Wealth Inc. Returns are net of fees and include reinvested dividends. The performance of the fund presented in this document may be for a different series of fund than the series that you hold in your account. The performance of the series that you hold may be different than what is shown. This information does not constitute an offer or solicitation to anyone in any jurisdiction in which such an offer or solicitation is not authorized, or to any person to whom it is unlawful to make such an offer or solicitation. These products may not be appropriate for all investors. Important information about the funds is contained in the offering documents which should be read carefully before investing. You can obtain these documents from ZLC Wealth Inc. Please speak to a ZLC Wealth Portfolio Manager or Representative to determine if these products are right for you.