Letter from the President:

HINDSIGHT IS 2020

If only we had known what 2020 would look like, how rich we would be! We might have bought Tesla in 2019 at $83 and sold it now for over $800. Or bought AbCellera, founded by UBC researcher and nouveau Vancouver billionaire Carl Hansen, a company in the right place at the right time developing antibodies that are effective against COVID infections, now with a $10 billion market cap. We could have sold all our equities in February when the S&P500 was at 3,380 and bought them back in March when it dipped to 2,237. We could have bought a tanker full of oil when the futures price went to -$37.63 (that is negative $37.63) and sold it for over $50.

Investing is so easy in hindsight. But no one has hindsight.

Who would have guessed that the Dow could go up over 400 points on January 6, the day thugs invaded the Capitol building in Washington. I think this comment on Twitter sums up the unbelievability of the attack:

“We spend $750 billion on defense and the center of American government fell in two hours to duck dynasty and the guy in the Chewbacca bikini“

How did the market go up on a day like this? Well, the theory is that the Georgia Senate election, which also happened on January 6, gave us a “Goldilocks scenario”: A Democratic president with a very slim hold on the Senate giving the US government the majority to pass additional fiscal support but not enough of a majority to pass more ambitious legislation like raising taxes or a Green New Deal. The market liked what it saw, and stocks went up.

So what do we, your advisors, say to you in a world like this?

Well, we say what we always have. Follow the ZLC Wealth principles of good investing. Take a long-term view, have reasonable diversification across strategies and holdings, favor value style, and be rational not emotional. As always, we keep true to our principles of good investing:

- Diversify appropriately: A mix of asset classes reduces the risk of loss.

- Invest with conviction: Use relatively few managers that are concentrated and who pick the right companies in the right sectors, then have the patience to wait.

- Include small and mid-sized companies: They often fly under the radar.

- Have a value-style bias: Invest like a business owner, not a speculator.

- Don’t overlook alternatives: These are often neglected by retail investors.

- Keep core fixed income conservative: Don’t reach too high for yield.

In the long term, we think these principles drive the best risk-adjusted returns.

THE YEAR IN REVIEW

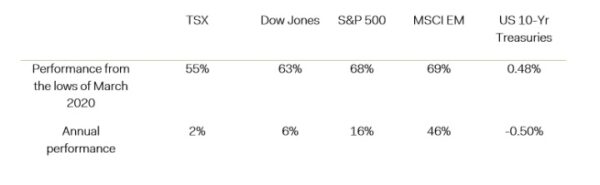

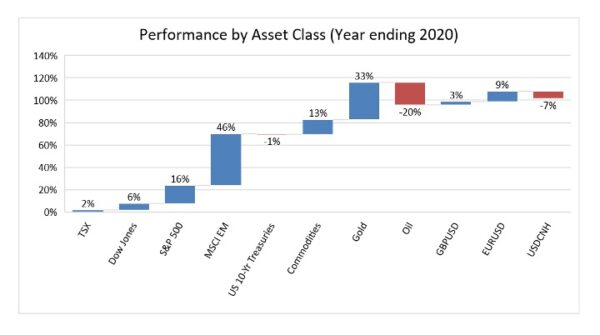

The year 2020 will certainly be one that will remain etched in most investors’ memory for a long time. World stock markets reached all time-highs exceeding most forecasts, all amid a global pandemic with varying degrees of lockdowns that inhibited economic activity. While the S&P/TSX ended 2020 flat, other indices such as the S&P 500 soared and posted a whopping 16% growth over 2019. This surprising outperformance in equity markets has been attributed to several factors:

- Generous stimulus and relief packages that supported smaller businesses and people who could not work during lockdowns, boosting employment, general economic activity and consumer confidence, and paving the way to a buoyant stock market as investors felt more confident in the economy.

- Since the onset of the pandemic, Central Banks, in an attempt to prevent an economic slowdown, flushed the financial markets with liquidity using low interest rate and quantitative easing. This sent government bond yields to an all-time low which lowered discount rates for equity valuation, driving equity prices higher.

- Vaccine approval and vaccine rollout in late 2020 boosted expectation of a return to a normal economy, driving performance of small cap and value stocks in particular.

- The relative outperformance of the S&P 500 vis-à-vis the S&P/TSX index has been attributed to the fact that growth stocks (a major component of the S&P 500) were preferred to traditional value stocks like financials, materials, industrials and energy which make up more than 50% of the S&P/TSX index.

In year that was characterized by excessive volatility, investors didn’t shy away from the stock market.

HEADWINDS AHEAD

As COVID cases rise and governments and states impose new lockdown measures to contain the virus and limit pressure on healthcare, the next thing to turn our attention to will be how quickly approved vaccines from Pfizer, Moderna and AstraZeneca can be manufactured, distributed and administered on a mass scale to allow life to return to normal this year. The next 6 months will be crucial in for the rollout plans and three issues have to be kept in mind. First, the willingness of the population to get vaccinated given the highly divided opinions over the content of the vaccine, second, the effectiveness of vaccines in light of the new mutating strains and third, logistical difficulties in rolling out a successful distribution of vaccines.

OUTLOOK FOR 2021

Canada outlook

Analysts at Russell Investments forecast that the Canadian economy will grow at 5% in 2021. The economic growth will be supported by renewed business activity as provinces ease lockdowns based on vaccine distribution. Travel and oil demand will pick up, and the savings boost of 2020 coupled with low interest rates for the rest of this year should further support recovery.

We expect strength in value stocks in traditional sectors that make up a major portion of the S&P/TSX gain as companies realize better earnings than last year. Energy, materials, industrial and the financial sector have been out of favor in 2020 due to the pandemic. However, as we saw last November, vaccine rollout plans prompted investors to rotate away from pandemic-resilient stocks to cheaper value and non-U.S. stocks.

Bank of Canada is not expected to raise the policy interest rate (which currently sits at 0.25%) in 2021 due to subdued inflation, as confirmed in their last December 2020 meeting.

United States outlook

New lockdown orders amid exploding infection rates across some states in the US will probably set back recovery and growth in Q1. However, we should expect to see a reversal in this trend in the post-vaccine period. Economists believe the post-vaccine period (second half of 2021) will deliver another strong recovery with real GDP growth exceeding 5% in 2021.

A largely accommodative Fed, coupled with low interest rates and low inflation, will continue to favor equities over bonds.

Eurozone Outlook

With a fresh wave of COVID infections, many countries in the Eurozone have been prompted into lockdowns and curfews which are expected to last well into January in some cases. In the event that lockdown orders are reinstated, we should expect to see a decline in economic activity for Q1 2021.

European benchmarks have underperformed their US counterparts in 2020 on account of their exposure to cyclically sensitive sectors such as industrials, materials and energy, and its small exposure to technology. The post-vaccine phase should nudge investors towards these cyclical sectors as economic activity picks up and yield curves steepen.

China Outlook

The Chinese economy has returned to almost pre-pandemic output levels. Its economic growth has mostly been supported by its success in curtailing infection rates and a robust manufacturing sector. The government and People’s Bank of China have been discussing when to start reducing the amount of stimulus. Many believe that support from the government will mainly be in the form of fiscal initiatives as opposed to monetary ones. Fiscal policy should remain accommodative through 2021 as the government strives to promote domestic consumption to drive economic growth and reduce the country’s reliance on exports.

An Optimists View Going Into 2021

The world is a troubled place and 2020 will always be remembered as a tough year, but we remain conservatively optimistic in our general outlook. Balance and diversification, in life and in portfolio building, are often warranted. It never pays to be pessimistic. The world adapts and moves forward. We are rational optimists. To quote author and TED speaker Simon Sinek:

“Optimism is about the future. It is not blind positivity nor is it naïve. It is not seeing the glass as half full and ignoring the half of the glass that is empty. It is the ability to see the emptiness of half the glass while choosing to focus the fullness of the other half of the glass. It is the ability to see the good in the face of the bad. It is the practice of looking for the silver-linings in any cloud. 2020 definitely gave us lots of “half empty” things to see. However, this New Year will be defined by our ability to see the “half full” moments” -Simon Sinek.

References:

https://russellinvestments.com/ca/global-market-outlook

https://www.forbes.com/advisor/investing/stock-market-year-in-review-2020/

DISCLAIMER: This newsletter is solely the work of the author for the purpose to provide information only. Although the author is a registered Investment as a Portfolio Manager at ZLC Wealth Inc. (ZLCWI), this is not an official publication of ZLCWI. The views (including any recommendations) expressed in this newsletter are those of the author alone, and are not necessarily those of ZLC Wealth Inc. The information contained in this newsletter is drawn from sources believed to be reliable, but the accuracy and completeness of the information is not guaranteed, nor in providing it does the author or ZLCWI assume any liability. This information is not to be construed as investment advice. Your own circumstances have been considered properly and that action is taken on the latest available information. This newsletter is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This information is given as of the date appearing on this newsletter, and neither the author nor ZLCWI assume any obligation to update the information or advise on further developments relating to information provided herein. This newsletter is intended for distribution in those jurisdictions where both the author and ZLCWI are registered to do business. Any distribution or dissemination of this newsletter in any other jurisdictions is prohibited. The rate of return shown is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of the Fund or returns on investment in the Fund. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the offering memorandum or prospectus of the Fund before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Performance results are not guaranteed, values may change frequently and past performance may not be repeated.

IMPORTANT INFORMATION: The above commentary may contain an update on certain funds offered through ZLC Wealth Inc. Returns are net of fees and include reinvested dividends. The performance of the fund presented in this document may be for a different series of fund than the series that you hold in your account. The performance of the series that you hold may be different than what is shown. This information does not constitute an offer or solicitation to anyone in any jurisdiction in which such an offer or solicitation is not authorized, or to any person to whom it is unlawful to make such an offer or solicitation. These products may not be appropriate for all investors. Important information about the funds is contained in the offering documents which should be read carefully before investing. You can obtain these documents from ZLC Wealth Inc. Please speak to a ZLC Wealth Portfolio Manager or Representative to determine if these products are right for you.