By Jon McKinney

President & Portfolio Manager

A Letter from the President:

My grandchild count is now up to 5! Three boys and two girls, all lovely. It is such an exciting time – becoming a grandparent. It may be a hard time for the parents as many of you know, but it’s fun for the grandparents who can wind them up and kiss them goodbye.

It’s the cycle of life. We grow, we start a career, we build a life. We work and save. We save for retirement. The goal is to accumulate the assets that will allow us to live the life we want in our “later years” when we finally sell our business or retire.

Accumulated savings will fund retirement, but they also allow us to give back, to give to our children, our community, or the world beyond. In life and in death, we want to make a difference. For some it’s a big deal: The Pattison Pavilion at VGH, the Beedie School of Business at SFU, and the Robert H. Lee Graduate School at the UBC Sauder School of Business, to name a few big ones.

For most it is much smaller, but it is just as important, and the goal is always the same – to improve the lives of others. If there is one goal most of us share, this is it.

Your wealth represents more than just numbers on a statement, it embodies your hard work, your values and the legacy you wish to leave behind. Yet, as much time as we spend accumulating and managing wealth, we often spend less time considering how the next generation will use it and preserve it. The reality is that the transfer of wealth is not just a financial transaction. It’s a deeply personal process that requires careful thought and planning and requires the help of experts to guide the legal, financial and emotional aspects of the transfer.

On September 26, we held a seminar on the importance of preparing for the transfer of both wealth and success to the next generation. Our guest speaker was Tom Deans, Ph.D., a well-known intergenerational wealth expert who works with families like you to help navigate the complexities of estate planning. His latest book, The Happy Inheritor, walks us through ways to prepare families for the smooth transition of wealth, and highlights the danger of the not-uncommon destructive family breakdowns over estates.

If you didn’t get a copy of the book at our seminar let us know and we will send one over.

The mission of ZLC is to play a role in your journey.

We at ZLC Wealth are portfolio managers focused on preserving and growing investment assets, and we are regulated at the highest level in the investment industry. Tom and Yin are Chartered Financial Analysts (CFA) and I’m a Chartered Investment Manager (CIM). By law, we have a fiduciary responsibility to put your interests first.

Our sister company ZLC Financial focuses on detailed financial planning, sophisticated insurance solutions and effective tax strategies. As a tightly integrated ZLC group, we bring together the experts who can help you build your wealth and achieve the estate plan you desire.

So how does ZLC Wealth add value?

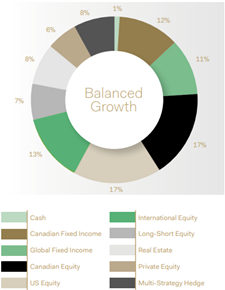

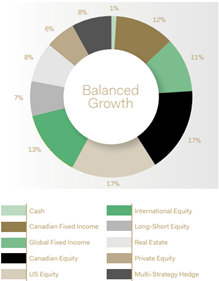

After 40 years in financial services, it is clear to us that the best way to grow assets – other than through building your own business – is to build a diverse portfolio that offers growth and protection. Equities for growth and bonds and alternatives for growth and protection.

In our best thinking portfolios, equities are diversified across Canada and the US, other “developed” countries (Europe, Japan, South Korea), and “emerging” countries (China, India, Brazil). In bonds we primarily look for safety. Our alternative assets reduce risk using long and short investments, and our real estate assets are uncorrelated to the volatility of equity markets. While you’ve seen this before, it’s important to note our principals of good investing:

Talk to us about your investments, but also talk to us about your estate plans and we’ll introduce our advisors from the diverse group of specialists here at ZLC Wealth and ZLC Financial to get you the answers you need.

Below is a review of the market trends in the third quarter prepared by Yin Chan, CFA, our Investment Analyst

Q3 2024 UPDATE

In the third quarter of 2024, markets have navigated a period of uncertainty, but encouraging signals are emerging. With inflation easing and central banks beginning to lower interest rates, the economic landscape is gradually shifting toward greater stability. These adjustments, though incremental, are setting the stage for renewed growth as we move into 2025, even with some concerns about the risk of entering the next economic cycle. As always, our focus remains on leveraging these changes through our well-diversified strategies to position our investors to benefit from the opportunities ahead.

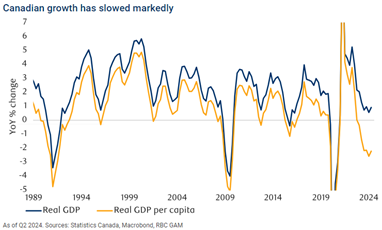

Chart Source: RBC Global Asset Management, MacroMemo – September 24-October 14, 2024

The Canadian economy has experienced a slowdown in growth, as highlighted by the above chart showing year-over-year changes in real GDP and real GDP per capita. After a sharp rebound following the economic disruptions of 2020, growth has decelerated markedly in 2024. Both real GDP and GDP per capita have declined, reflecting the broader challenges facing the economy, including subdued consumer demand and slower productivity gains1. While the current environment remains challenging, we anticipate more favorable conditions as policy adjustments take hold.

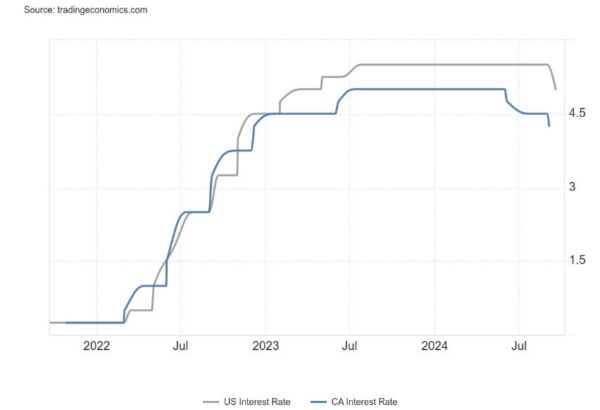

Chart Source: Trading Economics, Canada Interest Rate Compared to US Fed Funds Interest Rate

In September, the Bank of Canada implemented its third consecutive 25 basis points rate cut, lowering the key interest rate to 4.25%2. Looking ahead, we expect these rate cuts to further support corporate earnings and consumer demand, particularly in sectors sensitive to borrowing costs. Similarly, the Federal Reserve’s decision to cut the federal funds rate by 50 basis points last month, which is the first reduction since 2020, was a significant development2. This move, coupled with expectations for an additional easing by the end of 2024, has bolstered investor confidence. Both U.S. and Canadian equities remain well-positioned for growth into 2025, with improving economic conditions and declining inflation providing a favorable backdrop.

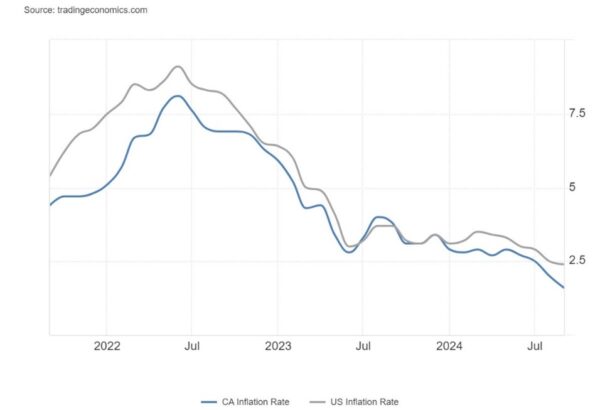

Chart Source: Trading Economics – Canada Inflation Rate Compared to US inflation Rate

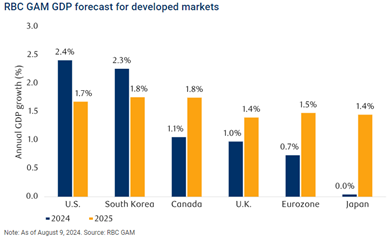

Chart Source: RBC Global Asset Management, One Minute Market Update – Fall 2024

Looking to the forecast, research suggests that the global economy is expected to experience moderate but steady growth, supported by the easing of monetary policies and interest rate cuts across developed markets. Canada’s growth rates are projected to improve from 2024 levels4. Despite potential risks from geopolitical tensions in regions such as the Middle East, Ukraine, and China, along with uncertainty surrounding the U.S. election, the overall outlook remains constructive. Central bank actions will help mitigate the risk of recession and set the stage for a more stable economy.

In facing the uncertainty of the market, rather than reacting impulsively to short-term market movements or chasing trends, our diversified, long-term approach allows us to navigate volatility with confidence, ensuring steady growth for our investors over time. As we enter the final quarter of 2024, we remain confident that the groundwork laid this year will continue to support a favorable investment climate as we head into 2025.

Sources:

1 Lascelles, Eric (2024, September 24)MacroMemo – September 24 – October 14, 2024, RBC Global Asset Management. https://www.rbcgam.com/en/ca/article/macromemo-september-24-october-14-2024/detail

2 Trading Economics (n.d.) Canada interest rate. https://tradingeconomics.com/canada/interest-rate

3 CTrading Economics, (n.d.) Canada inflation rate.. https://tradingeconomics.com/canada/inflation-cpi

4 RBC Global Asset Management (n.d.) One Minute Market Update – Fall 2024. RBC Global Asset Management. https://www.rbcgam.com/en/ca/article/one-minute-market-update-fall-2024/detail

Disclaimer:

This newsletter is solely the work of the author for the purpose to provide information only. Although the author is a registered Investment as a Portfolio Manager at ZLC Wealth Inc. (ZLCWI), this is not an official publication of ZLCWI. The views (including any recommendations) expressed in this newsletter are those of the author alone, and are not necessarily those of ZLC Wealth Inc. The information contained in this newsletter is drawn from sources believed to be reliable, but the accuracy and completeness of the information is not guaranteed, nor in providing it does the author or ZLCWI assume any liability. This information is not to be construed as investment advice. Your own circumstances have been considered properly and that action is taken on the latest available information. This newsletter is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This information is given as of the date appearing on this newsletter, and neither the author nor ZLCWI assume any obligation to update the information or advise on further developments relating to information provided herein. This newsletter is intended for distribution in those jurisdictions where both the author and ZLCWI are registered to do business. Any distribution or dissemination of this newsletter in any other jurisdictions is prohibited. The rate of return shown is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of the Fund or returns on investment in the Fund. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the offering memorandum or prospectus of the Fund before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Performance results are not guaranteed, values may change frequently, and past performance may not be repeated.

IMPORTANT INFORMATION: The above commentary may contain an update on certain funds offered through ZLC Wealth Inc. Returns are net of fees and include reinvested dividends. The performance of the fund presented in this document may be for a different series of fund than the series that you hold in your account. The performance of the series that you hold may be different than what is shown. This information does not constitute an offer or solicitation to anyone in any jurisdiction in which such an offer or solicitation is not authorized, or to any person to whom it is unlawful to make such an offer or solicitation. These products may not be appropriate for all investors. Important information about the funds is contained in the offering documents which should be read carefully before investing. You can obtain these documents from ZLC Wealth Inc. Please speak to a ZLC Wealth Portfolio Manager or Representative to determine if these products are right for you.