A letter from the President:

Where’s The Remote?

One of the first words my 16-month-old grandchild mastered is “remote”. Well, sort of, he says “mote”. The device turns on our TV, but it also controls music, our Mac, Netflix and Prime Video. My wife and I barely know how to use it and if we want to watch Netflix, we usually have to call my children (they’re in their thirties) to figure out our passwords. Whether we are trying to get Apple Car Play to link to our car, download a Huberman Lab podcast, or just watch a show, technology is both our friend and our enemy. You may have noticed we have entered a period of quickly changing technology. Again.

A Brand New World

In the early 1900s, humanity’s lifestyle had remained largely unchanged for millennia. Humans had traveled, listened to music, and consumed information largely in the same way as every single generation before them. However, within just a few decades, a profound transformation swept through society, propelled by remarkable technological advancements and innovations. The introduction of the automobile, aviation, radio, and countless other inventions had made life unrecognizable to those who had experienced it just half a century prior.

Jumping ahead a few decades, we find that new breakthroughs in computing, transportation, aviation, and even space exploration have reshaped our understanding of what humanity can accomplish. These advancements have not only expanded our horizons but have become so integral to our everyday lives that many of us cannot imagine life without the conveniences and gadgets developed in the last century.

Fast forward to today, and we are similarly witnessing remarkable progress in every facet of life, a significant evolutionary shift. We are experiencing a brand-new industrial revolution, marked by groundbreaking innovations in artificial intelligence, machine learning, renewable energy production, and the use of electric and driverless vehicles. Humanity is embarking on a new path toward a future that will look vastly different from today, leaving us in a state of shock, amazement, and perhaps even fear, reminiscent of those who lived through the changes of the 1900s.

Will the roaring 2020s mirror the 1920s? More crucially, will this decade conclude in a similar fashion? Given our present landscape marked by inflation, elevated interest rates, geopolitical conflicts and escalating food and housing costs, can innovation truly thrive in this challenging environment? Amongst all the new opportunity and speculation, what value can investors find in this period of artificial intelligence, electric vehicles, and all the uncertainty these new technologies bring.

The AI Revolution

In just five years, Artificial Intelligence (AI) has evolved from a concept into a game-changer. AI applications like ChatGPT have revolutionized how professionals and business owners operate. They’ve automated tasks and boosted productivity and efficiency. ChatGPT, driven by natural language processing, has found utility in customer support, content generation, and virtual assistant roles. Its impact is evident in the reshaping of customer engagement and streamlining of daily operations, underscoring AI’s evolution from concept to indispensable practical tool. In fact, while this letter is 100% our own thoughts, our team employed ChatGPT to proofread our letter, improving grammar and coherence.

AI’s impact is not limited to automating redundant tasks. It also has the potential to enhance market efficiency by using advanced algorithms and pricing strategies to exploit market inefficiencies and quickly capitalize on short term price discrepancies [1].

Vancouver-based Sanctuary AI, known for building full-scale workforce robots, has partnered with Canadian Tire to deliver innovative labour solutions to help combat labour shortages. This pioneering commercial deployment has robots handling tasks such as merchandise packing, cleaning, tagging, labeling, and folding[2].

The Electric Vehicle Revolution is Just Getting Started

In August 2022, the California state legislature passed a law, set to take effect as early as 2035, banning internal combustion engines as part of a green economy transition. The European Union followed California’s lead, implementing a similar ban on new internal combustion engine sales by 2035. Canada is poised to follow, signaling the early stages of the Electric Vehicle (EV) revolution.

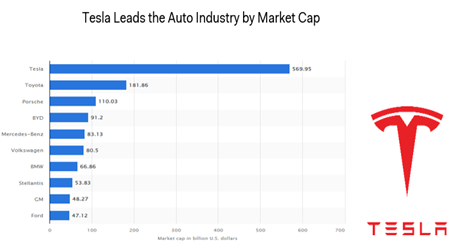

Electric vehicles have gone from 1% of new vehicle sales in 2017 to 14% in 2022. The Biden administration has thrown its weight and enthusiasm behind battery and vehicle manufacturers like Ford, Stellantis (Chrysler) and Tesla, aiming to lower EV costs and promote broader adoption[3]. Notably, Tesla has emerged as the standout success story in the EV sector, ascending to the forefront of both EV and overall automotive manufacturers, overwhelmingly surpassing major competitors by market capitalization[3].

Carlier, M. (2023, March 20). Global Market Value of Carmakers as of March 20, 2023 by Mareket Cap.

A Transition to a Greener Economy…Or is It?

One significant criticism often raised is the potential strain that widespread EV adoption could place on already overburdened power grids. As the number of EVs on the road increases, the demand for electricity will surge. This heightened demand could lead to power grid instability and electricity inequity, especially during period of peak strain on energy infrastructure.

Environmental concerns also arise from EV manufacturing. While EVs emit no tailpipe emissions, their production involves the harmful extraction of precious other minerals, as well as the production of petroleum-based plastics. The whole EV manufacturing process generates nearly double the carbon emissions of traditional vehicles[4].

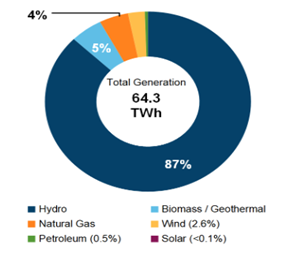

Expensive and often environmentally challenged energy infrastructure further complicates EV adoption in regions with stressed grids like California, where close to 50% of all energy is produced from power plants that burn fossil fuel[5]. Arguably, a region like British Columbia, where close to 95% of all energy produced is from renewable sources,[6] highlight the potential EV’s can have in the proper environment.

Canada Energy Regulator. (2023, August). Provincial and Territorial Energy Profiles –

Higher for Longer? How Interest Rates Impact Growth

A potential headwind for technological change is higher interest rates.

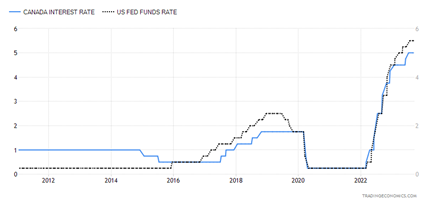

In September, the US Federal Reserve and the Bank of Canada maintained their key policy interest rates at 5.50%, and 5.00% respectively as this era of quantitative tightening continues[7]. Jerome Powell, the Fed chairman, indicated that additional rate hikes may be necessary as inflation rebounded modestly in the third quarter[8].

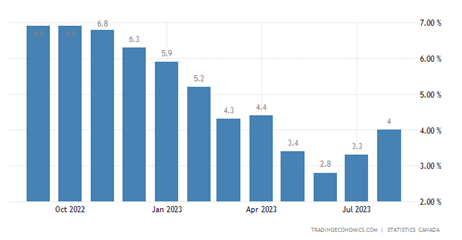

In Canada, inflation has fallen substantially from the historic 40-year highs seen in 2022, but current inflation rates still surpass the Bank of Canada’s target inflation rates of between 2%-3%. In fact, inflation rates rose from 2.8% in June 2023 to 4% in August[9].

Canada Annualized Inflation September 2022 – August 2023

Trading Economics. (2023, August). Canada Inflation Rate.

The recent rise in inflation has been attriburted mainly to the rising cost of fuel towards the end of September, with crude oil hitting an annual high of $93 a barrel on September 27, 2023. Additionally, rising rent, mortgage interest and grocery payments contributed to in inflation numbers[10].

How do high interest rates hinder the innovative spirit for which tech companies are known? Interest rates represent the cost of borrowing money, and currently, borrowing is expensive. Tech firms usually reinvest their cash in research and development. However, in a higher interest rate environment, a greater portion of cash is diverted to interest expense instead of innovation, potentialy hindering groundbreaking projects and slowing the pace of technological advancement.

Canada/US Interest Rates: January, 2011 – August 2023

Trading Economics. (2023, August). Canada Interest Rate.

Where do We Go from Here?

While it may seem that we are adopting a “doom and gloom” attitude, we are, in fact, recognizing a phenomenal opportunity in the markets. During periods of higher interest rates, or a “higher for longer” environment as we’re experiencing now, investors often grow fearful of the stock market and begin shifting toward higher yielding fixed-income investments like bonds or GICs.

This is where we, as portfolio managers see value in the market.

Warren Buffet, the most well-known and successful investor of our generation, is known for his investment strategy of buying good quality companies at attractive prices. How does he achieve this? He adheres to this timeless wisdom:

“Be fearful when others are greedy and be greedy when others are fearful.“[11]

We know we use that quote often when sentiment is negative, but it has never disappointed us in our mission to outperform expectations.

During our 2023 ZLC Wealth Client Update at the Terminal City Club in late September, we had the privilege of hearing from Andrew Pastor, a Portfolio Manager at EdgePoint Wealth. We include Andrew’s Canadian mandate in our portfolios because it aligns with our investment philosophy of investing in high-quality investments at attractive valuations. Another reason that we like EdgePoint is their willingness to include smaller companies in their holdings, an approach that often drives outsized returns.

Analytics firm Morningstar ranked EdgePoint’s Canadian portfolio performance in the top 1% of all Canadian equity managers in the Year-to-date, 1-year, 3-year, 5-year and 10-year results[12]! Amazing.

Should We Do Anything in the Short Term?

Many investors share concerns about the short-term outlook for their savings, particularly those who have spent decades shaping retirement plans with certain expectations. The fear is that the retirement they envisioned is now potentially at risk.

This climate of uncertainty has given rise to a prevailing sentiment among some investors: the urge to convert their investments into cash for what they perceive as safety. What these investors may not fully grasp is that cash has historically underperformed other asset classes. One significant drawback of holding cash is its inability to outpace inflation, a concern especially pronounced today given that inflation is at 20-year highs.

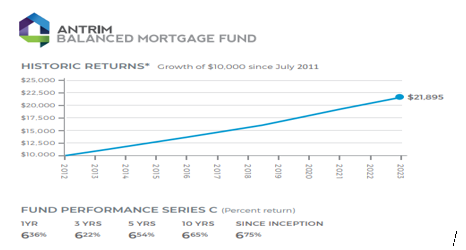

Our portfolios utilize a well-rounded investment approach that balances safety with consistent returns, and it incorporates relatively safe assets like the Antrim Balanced Mortgage Fund. In the current environment of higher interest rates, Antrim strategically capitalizes on short-term mortgages at elevated interest rates[13]. This fund, along with personalized advice and consistent reviews is what turns short term volatility into long term success.

Antrim Investments (2023, August); Antrim Balanced Mortgage Fund F-Class

What Are We Watching Out For?

As 2023 quickly comes to a close, we at ZLC Wealth remain vigilant in tracking market opportunities for the benefit of our clients. We pride ourselves on our “pension style” management principles and continue to guide our choices prioritizing value over speculation.

Our Investment Oversight Committee (IOC) meets regularly to discuss changes in the market and performs a review of all the funds included in our portfolios. As we approach the year-end and look ahead to 2024, the IOC is closely monitoring the Central Banks’ actions regarding interest rates and the implications of rising inflation. Furthermore, amidst escalating global tensions, we are keeping a keen eye on the performance of global markets.

Admin Update: Have you tried Piersight?

Our team remains focused on investment performance, but we are also working on streamlining and enhancing client engagement and improving the privacy and safety of your personal information.

Piersight is one of the improvements we’ve made aimed at simplifying your experience. Piersight is our new online client portal that lets you access your account holdings and quarterly statements at any time. All information is stored securely and is accessible 24/7.

For added security, Piersight has implemented 2-Factor Authentication (2FA) on its system. Coming soon, clients will no longer limited to exclusively using the Authy App for 2FA. Google Authenticator, Microsoft Authenticator and other popular 2FA authenticators will soon be included for further convenience.

If you haven’t yet signed up, please contact us at wealthinfo@zlc.net and we will be happy to assist you.

We look forward to continuing our work with you and are excited for the prospects that lie ahead.

Please feel free to reach out to us with any questions. We are happy to help in any way we can.

-The ZLC Wealth Team

- Garry Zlotnik FCPA, FCA, CFP, CLU, ChFC, Chief Executive Officer & Portfolio Manager

- Jon McKinney CPA, CA, CIM®, President & Portfolio Manager

- Tom Suggitt CFA, CIPM, CFP, FCSI, Vice President, Portfolio Manager & Head of Investment Oversight

- Grace Domingo, Vice President Administration

- Lisa Der, Senior Account Manager

- Mark van Koll CPA, CGA, FCSI, CAMS, Chief Compliance Officer

Disclaimer

This newsletter is solely the work of the author for the purpose to provide information only. Although the author is a registered Investment as a Portfolio Manager at ZLC Wealth Inc. (ZLCWI), this is not an official publication of ZLCWI. The views (including any recommendations) expressed in this newsletter are those of the author alone, and are not necessarily those of ZLC Wealth Inc. The information contained in this newsletter is drawn from sources believed to be reliable, but the accuracy and completeness of the information is not guaranteed, nor in providing it does the author or ZLCWI assume any liability. This information is not to be construed as investment advice. Your own circumstances have been considered properly and that action is taken on the latest available information. This newsletter is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This information is given as of the date appearing on this newsletter, and neither the author nor ZLCWI assume any obligation to update the information or advise on further developments relating to information provided herein. This newsletter is intended for distribution in those jurisdictions where both the author and ZLCWI are registered to do business. Any distribution or dissemination of this newsletter in any other jurisdictions is prohibited. The rate of return shown is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of the Fund or returns on investment in the Fund. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the offering memorandum or prospectus of the Fund before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Performance results are not guaranteed, values may change frequently, and past performance may not be repeated.

IMPORTANT INFORMATION: The above commentary may contain an update on certain funds offered through ZLC Wealth Inc. Returns are net of fees and include reinvested dividends. The performance of the fund presented in this document may be for a different series of fund than the series that you hold in your account. The performance of the series that you hold may be different than what is shown. This information does not constitute an offer or solicitation to anyone in any jurisdiction in which such an offer or solicitation is not authorized, or to any person to whom it is unlawful to make such an offer or solicitation. These products may not be appropriate for all investors. Important information about the funds is contained in the offering documents which should be read carefully before investing. You can obtain these documents from ZLC Wealth Inc. Please speak to a ZLC Wealth Portfolio Manager or Representative to determine if these products are right for you.

Sources:

1. Ligon, M. (2023, July). How Artificial Intelligence Is Revolutionizing Stock Investing. Retrieved from forbes.com:

https://www.forbes.com/sites/forbesbusinesscouncil/2023/07/17/how-artificial-intelligence-is-revolutionizing-stock-investing/?sh=14a3885e6485

2. Sanctuary AI. (2023, March). Sanctuary AI Deploys First Humanoid General-Purpose Robot Commercially. Retrieved from sanctuary.ai:

https://sanctuary.ai/resources/news/sanctuary-ai-deploys-first-humanoid-general-purpose-robot-commercially/

3. Carlier, M. (2023, March 20). Global Market Value of Carmakers as of March 20, 202 by Mareket Cap. Retrieved from statista.com: https://www.statista.com/statistics/1130533/global-market-value-of-carmakers-by-market-cap/

4. McKinsey & Company. (2023, February). The race to decarbonize electric-vehicle batteries. Retrieved from mckinsey.com:

https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/the-race-to-decarbonize-electric-vehicle-batteries

5. California Energy Commission. (2022). 2022 Total System Electric Generation. Retrieved from energy.ca.gov:

https://www.energy.ca.gov/data-reports/energy-almanac/california-electricity-data/2022-total-system-electric-generation#:~:text=Total%20utility%2Dscale%20electric%20generation,from%2093%2C333%20GWh%20in%202021.

6. Canada Energy Regulator. (2023, August). Provincial and Territorial Energy Profiles – British Columbia. Retrieved from cer-rec.gc.ca:

https://www.cer-rec.gc.ca/en/data-analysis/energy-markets/provincial-territorial-energy-profiles/provincial-territorial-energy-profiles-british-columbia.html

7. Trading Economics. (2023, August). Canada Intereest Rate. Retrieved trading economics.com:

https://tradingeconomics.com/canada/interest-rate

8. Horsley, S. (2023, September 20). The Federal Reserve holds interest rates steady but hints at more action this year. Retrieved from npr.org:

https://www.npr.org/2023/09/20/1200327332/federal-reserve-inflation-economy-interest-rates

9. Trading Economics. (2023, August). Canada Inflation Rate. Retrieved trading economics.com:

https://tradingeconomics.com/canada/inflation-cpi

10. Statistics Canada (2023, September). Consumer Price Index, August 2023. Retrieved from: www150.statcan.gc.ca:

https://www150.statcan.gc.ca/n1/daily-quotidien/230919/dq230919a-eng.htm

11.Brownlee, A (2023, September); Warren Buffet: Be Fearful When Others Are Greedy. Retrieved from: Investopedia.com:

https://www.investopedia.com/articles/investing/012116/warren-buffett-be-fearful-when-others-are-greedy.asp

12. Morningstar Analytics (2023, September) EdgePoint Canadian Portfolio Series F. Retrieved From: Morningstar.ca

https://www.morningstar.ca/ca/report/fund/parent.aspx?t=0P0000JO4N

13. Antrim Investments (2023, August); Antrim Balanced Mortgage Fund F-Class Retrieved from antriminvestments.com

https://antriminvestments.com/wp-content/uploads/2019/05/Fund_Fact_She