A Letter from the President:

IN WITH A BANG

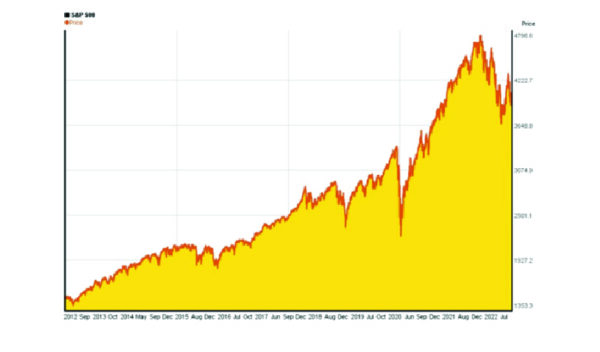

2022 started well. On January 3 the S&P 500 was at 4796, a record high. Then things turned. Today the index of large US companies is at around 3700, a drop of about 25%. The Canadian market has done a little better, mainly due to strength in the energy and materials sectors, but the TSX is also down, about 11% in 2022. Even investment-grade bonds are off by more than 10%.1

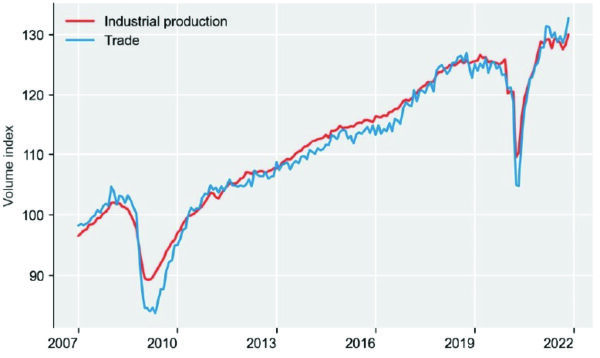

So, what is happening in 2022? Covid is where it started. Covid is still around, but we have adjusted to accept it as a part of our new normal. (I felt invincible to Covid, having not had it for over 2 years, but a month ago both my wife and I were infected). What we know now is that beginning in March of 2020, Covid shut down industrial production and killed the travel and leisure industries. 2

So how does this impact 2022?

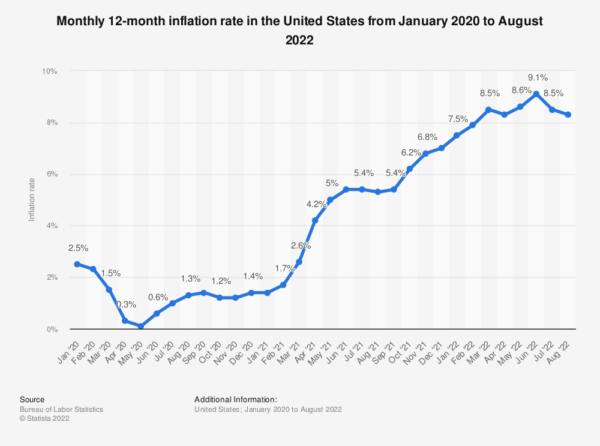

Inflation, Inflation, Inflation The issue is Inflation. The period of beautifully low inflation we experienced after the financial crisis of 2008/2009 delivered a nice steady growth in industrial output. The emergence of the Chinese economy and their monumental production capabilities kept product costs low. This changed under Covid. The graph below shows how Covid impacted US inflation, beginning in early 2020 after that period of nice 2% inflation.

The Chinese adopted a Zero Covid policy that has made a bit of a mess of Chinese-based production. Limits on Chinese production outputs combined with generous government subsidies, both in Canada and the US, have driven up demand for everything. The war in Ukraine of course has also been a factor, driving up energy and food costs worldwide, and hampering trade in general. Anyone looking to buy an electric car – or any car in 2022, would likely be on a waitlist.

In Canada, the September 2022 Consumer Price Index rose 6.9% on a year-over-year basis, decelerating from a 7.0% gain in August, marking the third consecutive monthly slowdown in headline inflation. 4 In the US, September’s inflation was reported on October 13 at 8.2%; lower than August at 8.3%, but higher than expectations of 8.1%. Inflation is retreating slightly but is still a significant concern.5

So why is inflation bad? Inflation is bad because interest rates need to exceed inflation on a long-term basis (lenders demand a real return), and because interest rates are the key tool central banks can use to control inflation. Interest rates are the price of money, and money is now expensive. Higher interest rates will generally slow the economy.

We can normally observe that there is an inverse relationship between interest rates and the value of assets. Generally, higher rates mean lower values. In real estate, higher Cap rates mean lower property values. (“Cap rate” is short for Capitalization rate or expected return on a property.) In bonds, higher rates cause bonds to sell off. In equities, higher rates generally mean lower stock prices (all things being equal).

THE ROAD AHEAD

The big question is, where will asset values go from here? I’ve been in the industry for a long time and if there is one thing we know for certain: Nobody knows.

Picking a bottom is impossible. In investing, we all climb the “wall of worry”. There is never a “good time” to invest. Or if it is a good time, everything will be very expensive. One of the most respected money managers on Wall Street wrote this:

“We are confronted with the latest reasons that mankind is doomed: global warming, global cooling, the evil Soviet empire, the collapse of the evil Soviet empire, recession, inflation, illiteracy, the high cost of health care, fundamentalist Muslims, the budget deficit, the brain drain, tribal warfare, organized crime, disorganized crime, sex scandals, money scandals, sex, and money scandals.”

This was in a book I’m reading called Beating the Street by Peter Lynch, published in 1993! This was almost 30 years ago, and most of those concerns still apply today. (“Evil Soviet Empire” then, equals “Evil Russian Empire” today.) Lynch ran the Magellan Fund which was huge (more than $100 billion) and had an amazing record. It is probably the most famous fund of that era. The point is: market timing is impossible.

Lynch also said this:

“Nobody can predict interest rates, the future direction of the economy, or the stock market. Dismiss all such forecasts and concentrate on what’s actually happening to the companies in which you are invested.”

Gareth’s Investment Letter: Q3 2022 Review

Bear Market Rally, or New Bull Market?

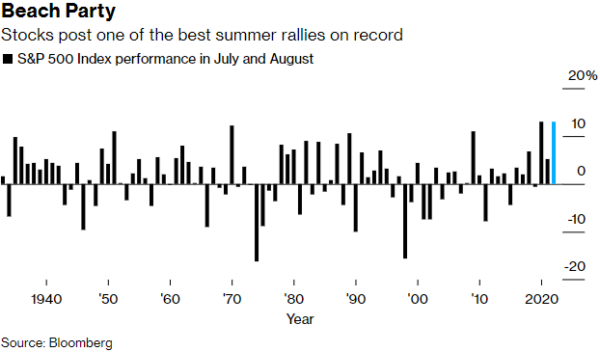

Financial markets continued to give us plenty to talk about over the past quarter with sentiment initially improving over the first half of the third quarter, before turning sour in August and continuing into the end of September.1 Some investors thought the strong July and August performance was the start of a new bull market and the worst was behind us, while others highlighted that it simply was going to be a bear market rally and that equity prices would go back down to their June lows. After a rough end to the quarter, many of the equity indices are at or below where they were in June and are sitting at their year-to-date lows. It’s not just equities that are having a tough year, the U.S. Aggregate Bond Index for example is down 14.6% year to date and has never declined more than 3% since 1976. An area of strength has been the U.S. Dollar Index which is having its strongest year on record and has gained over 17% in 2022, at the time of writing. Crude oil dropped 11.2% in September and has declined for the past four months.2

FED Chair Jerome Powell gave a speech at the end of August which ended the rally we were witnessing in the summer. He signaled the US central bank is likely to keep raising interest rates and leave rates elevated to stamp out inflation. Powell mentioned the overarching focus right now for the FED is to lower inflation to the 2% target of the central bank. Markets reacted sharply and all major indexes were down on the day of his much-anticipated speech.

Speaking of the FED, during the past quarter they raised interest rates by 75 basis points at both their July and September meetings, delivering the most aggressive tightening in more than a generation, to curb surging inflation.3

The Bank of Canada on the other hand raised interest rates by 100 basis points in July, much to the surprise of economists who were expecting only a 75 basis point hike. They weren’t as aggressive at their September meeting but raised the benchmark overnight rate by a further 75 basis points to 3.25%. Statistics Canada reported consumer price inflation cooled as gasoline prices fell by the most since the start of the pandemic.

US employers added a healthy number of jobs in August but saw the unemployment rate rise. Unexpectedly, the rate rose to 3.7% which was the firsts increase since January, as the participation rate climbed.4 It’s important to be aware and understand the current employment numbers because as a result of negative real incomes at the moment, many consumers need to use their savings and/or credit to support growth. However, if consumers lose their sense of job security, spending could slow down quickly, which is one reason monitoring employment data can give some insight to what may happen going forward.

Hikes, Hikes, and More Hikes

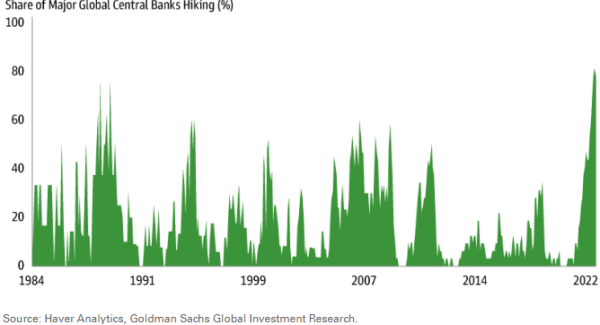

Central banks have been quick to react to the high inflation numbers and have been committed in their approach to increasing rates. For example, the share of global central banks that are currently raising their respective interest rates is at a record high; nearly 80% of major central banks are hiking.5 More rate hikes are expected in the fourth quarter, albeit at a slower pace than what we have seen over the past few hikes.

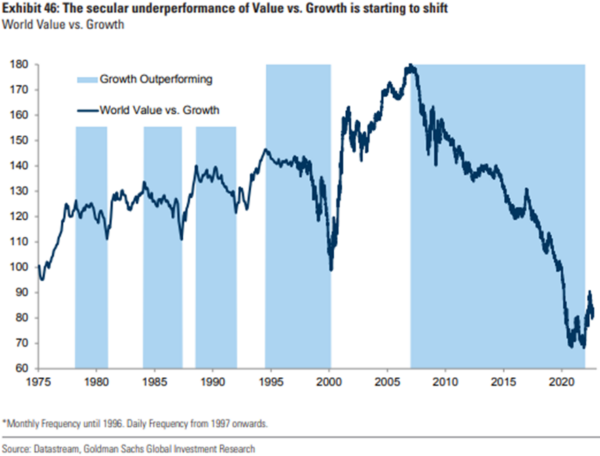

The graph below 6 shows there has been a long stretch of time, from after the 2008 financial crisis, where growth has outperformed value. However, value is starting to outperform this year and those who have had some exposure to value have benefited from its relative outperformance to growth stocks as of late. It’s important to be diversified and not be solely invested in one style of equities. With interest rates increasing, the growth stocks that were great to have during the market recovery of 2020 after the pandemic, are not looking all that enticing right now.

HOPING FOR A SOFT LANDING

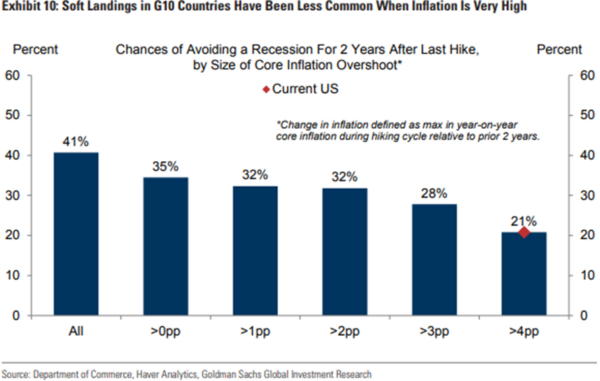

The preferred outcome with where we are in the economic cycle is that higher interest rates will reduce demand enough to where inflation will slow down, but not cause a recession by killing economic growth. What the chart below shows is that in G10 countries, soft landings have historically been less common when inflation is very high. If economic growth does slow down significantly in the near future and we do find ourselves in a recession, it is that much more vital to stick to a long term strategic asset allocation.

As we have said in the past, with many economic variables and a world that is so uncertain, timing the market is very difficult. As we all experienced during the Covid pandemic, supply chain disruptions resulted in the price of certain goods rising, and as supply chains continue to get closer to normal, the price of some goods should ease although companies are still having a difficult time filling many positions.

Despite inflation still being elevated, there are some signals that inflation is slowing. Global container freight rates for example hit an 18-month low, down 61% from their peak. Crude oil is down close to 40% from its March peak and used car prices are down 13% over the last 9 months.7 Used car prices were a leading indicator of higher inflation rates in 2020 and the recent downturn could also be a leading indicator of lower inflation to come.

US consumer confidence rose for a second month in September to the highest level since April.8 Companies will be hoping that this increase in confidence will lead to strong consumer spending into the remainder of the year and the holiday shopping season.

Gareth Langdon, CFA

Sources:

1 Kirkland, S. (2022, August 17). Stocks rise as dip buyers emerge in seesaw session: Markets wrap. Bloomberg.com. Retrieved from https://www.bloomberg.com/news/articles/2022-08-17/stocks-set-to-dip-as-traders-mull-fed-china-risks-markets-wrap

2 The Market Intelligence Desk Team. (2022, October 3). September, Third Quarter 2022 review and Outlook. Nasdaq. Retrieved from https://www.nasdaq.com/articles/september-third-quarter-2022-review-and-outlook

3 Marte, J., & Saraiva, C. (2022, July 27). FOMC: Fed raises interest rates by 75 basis points to double down on inflation. Bloomberg.com. Retrieved from https://www.bloomberg.com/news/articles/2022-07-27/fed-raises-rates-by-75-basis-points-to-double-down-on-inflation?srnd=premium-canada

4 Pickert, R. (2022, September 2). US employment report August 2022: 315,000 jobs added, wages rise. Bloomberg.com. Retrieved from https://www.bloomberg.com/news/articles/2022-09-02/us-adds-315-000-jobs-as-participation-jumps-and-wages-rise?srnd=premium-canada

5 Goldman Sachs Asset Management. (2022, September 23). Chart of the Week: Hike it Like That. Market Monitor. Retrieved from https://www.gsam.com/content/gsam/us/en/advisors/market-insights/market-strategy/global-market-monitor/2022/market_monitor_092322.html

6 Oppenheimer, P. (2022, September 7). Bear Repair: The Bumpy Road to recovery. Goldman Sachs Research. Retrieved from https://www.goldmansachs.com/insights/pages/bear-repair-the-bumpy-road-to-recovery.html

7 Bilello, C. (2022, September 26). 10-Chart Monday (9/26/22). Compound Advisors. Retrieved from https://compoundadvisors.com/2022/10-chart-monday-9-26-22

8 Saraiva, A. (2022, September 27). US Consumer Confidence rises a second month to most since April. Bloomberg.com. Retrieved from https://www.bloomberg.com/news/articles/2022-09-27/us-consumer-confidence-rises-a-second-month-to-most-since-april?srnd=markets-vp

DISCLAIMER: This newsletter is solely the work of the author for the purpose to provide information only. Although the author is a registered Investment as a Portfolio Manager at ZLC Wealth Inc. (ZLCWI), this is not an official publication of ZLCWI. The views (including any recommendations) expressed in this newsletter are those of the author alone, and are not necessarily those of ZLC Wealth Inc. The information contained in this newsletter is drawn from sources believed to be reliable, but the accuracy and completeness of the information is not guaranteed, nor in providing it does the author or ZLCWI assume any liability. This information is not to be construed as investment advice. Your own circumstances have been considered properly and that action is taken on the latest available information. This newsletter is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This information is given as of the date appearing on this newsletter, and neither the author nor ZLCWI assume any obligation to update the information or advise on further developments relating to information provided herein. This newsletter is intended for distribution in those jurisdictions where both the author and ZLCWI are registered to do business. Any distribution or dissemination of this newsletter in any other jurisdictions is prohibited. The rate of return shown is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of the Fund or returns on investment in the Fund. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the offering memorandum or prospectus of the Fund before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Performance results are not guaranteed, values may change frequently, and past performance may not be repeated.

IMPORTANT INFORMATION: The above commentary may contain an update on certain funds offered through ZLC Wealth Inc. Returns are net of fees and include reinvested dividends. The performance of the fund presented in this document may be for a different series of fund than the series that you hold in your account. The performance of the series that you hold may be different than what is shown. This information does not constitute an offer or solicitation to anyone in any jurisdiction in which such an offer or solicitation is not authorized, or to any person to whom it is unlawful to make such an offer or solicitation. These products may not be appropriate for all investors. Important information about the funds is contained in the offering documents which should be read carefully before investing. You can obtain these documents from ZLC Wealth Inc. Please speak to a ZLC Wealth Portfolio Manager or Representative to determine if these products are right for you.