Letter from the President:

Every week, I have the great pleasure of meeting our clients, mostly through Zoom these days although a few have ventured into our office and sat with masks on across our big boardroom table. At meetings we cover basic things like TFSA and RRSP contributions. We cover portfolio risk and we often do planning, but often a client asked something like: Where is this market going? It’s a tough question and if I knew I would be a billionaire. (I’m not.) What I can tell you, is the market is trying to process two key factors, Covid and inflation.

Covid first. It seems that every time we start to think it’s over, we get another wave. We are in the fourth wave now and while we Canadians were pretty smug about how well we were doing earlier (remember how we used to clap for nurses and doctors at 7pm every day?), we’re not out of the woods just yet. The Delta variant is bad enough (over 90% of current cases1), but two new variants are getting some press. Mu (named for the Greek letter) is a World Health Organization “Variant of Interest” and C.1.2 (identified in South Africa) is not yet a VOI but is being closely watched2.

Also of some concern is a recent Pfizer/BioNTech research report which found that the efficacy of the double vaccine wanes over time, dropping from 88% to 47% effectiveness after six months3. The U.S. Food and Drug Administration has authorized the use of a Pfizer/BioNTech booster for persons of high-risk. While scientists have called for more data, the argument is building for boosters for all (not a bad thing for Pfizer shareholders).

On the positive, most are now vaccinated (75.96 % in Canada4 and 65.1% in the US5 as of October 5) and AstraZeneca, the drugmaker that developed one of the first COVID-19 vaccines, has asked the U.S. Food and Drug Administration to authorize the use of its antibody shot, a potential major step in the global fight to combat Covid6.

Notwithstanding some ups and downs in the world’s battle with Covid, the general view is this too will pass.

Inflation is probably the bigger issue for markets as it has a direct impact on interest rates, valuations, consumer spending, corporate profitability, and central bank stimulus. Some inflation is good. The Bank of Canada and the US Federal Reserve Bank like 2%7,8. Too little inflation or deflation is bad, and too much inflation can be a problem as interest rates must rise to compensate investors, potentially killing the economy. The debate now is whether the inflation we have now is “transitory” or is part of a trend to an inflationary world.

Gareth Langdon, our “newish” investment analyst (he started in June) and member of our Investment Oversight Committee, takes a look at inflation and the market this quarter in his commentary below.

FROM THE DESK OF GARETH LANGDON:

300 Billion:

During the third quarter of 2021 we saw a little bit of everything happen in the world from a federal election in Canada to one of China’s largest real estate developers, Evergrande, teeter on the verge of bankruptcy. Looking back in the rear-view mirror we now know that the election really turned out to be a nonevent. The Evergrande story out of China on the other hand has been much more interesting (unless you’re one of those weird political junkies). The traction of the Evergrande story led to some short-term market volatility as investors worried about the possible fallout of one of China’s largest developers and the implication this could have globally with such a globalized market. Their debt has ballooned to more than $300 billion, a crazy number to wrap your head around.9 The Evergrande story is far from over, but for now, it looks like it will not be a catalyst for an extreme sell off that some Bears have been calling for. The Evergrande situation is a good reminder that there are vulnerabilities than can be hard to anticipate. It shows the importance of having a diversified portfolio while not being too concentrated in any one industry, region, or asset class.

Rates:

At the end of September, we saw the U.S. 10 Year Treasury yield pushed higher to touch 1.5% which was a level that had not been hit since June. However, its crucial to remember that despite the initial uptake in current rates, they are well below historical averages.10 UBS had this to say about the current situation:

“The gradual shift in central bank policy reflects optimism over economic growth, rather than worries over inflation. Rather than ending the equity rally, we expect the rise in yields to favour cyclical sectors such as financials and energy, over growth sectors such as technology” 11

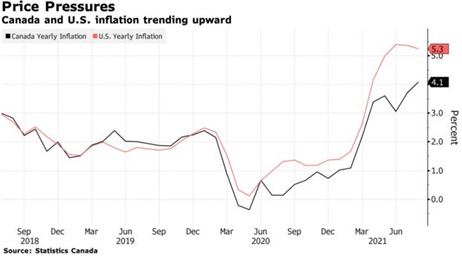

Speaking of inflation, as mentioned in our last quarterly letter, we were watching very closely on inflation figures to see what sort of numbers would come through the summer months. Well, we have the answer: The Consumer Price Index in Canada accelerated to 4.1% in August which is the fastest pace since 2003 and the fifth consecutive month of inflation readings above the Bank of Canada’s 3% cap.12 As expected, the Bank of Canada left rates unchanged and did not change their current bond purchase program on their meeting that took place on September 8th. All eyes will be on the next interest rate announcement and monetary policy report on October 27th followed by the final Announcement of 2021 on December 8th…get your popcorn ready!

Powell:

In August, the annual Jackson Hole Economic Symposium took place with Fed Chair Jerome Powell giving his much-anticipated speech which markets took as a positive sign. He reiterated the central banks accommodative stance of keeping interest rates low, although he did mention the bank would slow down their asset purchase program soon. More recently, Powell has also been busy warning about the growing concern of the U.S. Treasury needing to raise the debt ceiling given they expect to run out of cash in a matter of weeks. Luckily, the U.S. senate has voted to temporarily raise the nation’s debt ceiling until December. In December I’m sure the same process will occur, and financial news will warn about the catastrophic consequences if the ceiling isn’t raised, only for it to be raised yet again. Rinse and repeat.

TINA:

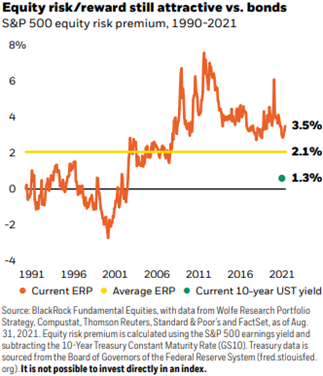

One recent acronym that I have been thinking about lately with interest rates so low is “TINA” (There Is No Alternative). That’s great, but what does that mean? Well, it, refers to the current situation where bonds offer such low yields, investors don’t really have options in their search for yield, and so keep plowing into equities to try and grow their net worth13. The “There Is No Alternative” to equities argument can be made even stronger when looking at the Equity Risk Premium (ERP) in the below chart. The ERP values stocks based on the prevailing 10-year Treasury rate. The ERP gauges whether investors are compensated for the greater risk in equities versus “risk-free” government bonds. The ERP has been well above its long-term average for the past 10 years. This suggests stocks are undervalued for the relative risk/reward they offer according to BlackRock’s Chief Investment Officer for U.S Fundamental Equities, Tony DeSpirito 14.

The big risk however to the TINA argument simply put is, you guessed it, our good friend inflation. If we do see secular inflation drag out, central banks will be forced to raise rates which will raise bond yields.

Our skillset at ZLC is not being able to accurately anticipate or predict inflation, but rather create portfolios that can respond well to it based on asset allocation. and This is what we continue to do despite the everchanging headlines on inflation and central bank rhetoric.

Blowout Earnings:

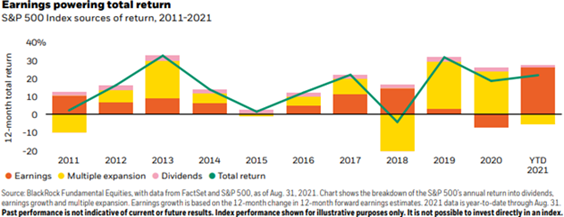

While many of us took the opportunity during the summer months to take some well-earned R & R, we might have missed the stellar earnings period that came and went. The below graph produced by BlackRock showcases the Year-to-Date sources of return for the S&P 500 index which is almost entirely explained from earnings.

Despite the remarkable earnings we have recently seen, they will eventually peak if they haven’t already. In our last client letter we highlighted the substantial amount of savings in the economy, and clearly some of those savings have been put to use during the summer months as equity markets pushed higher on the back of these strong earnings results. We will be keeping a close eye to see how the next few earnings reports go and what that can tell us about the pace of growth in the economy and which industries continue to be robust.

The rebound from the lows of March 2020 really have been outstanding and the recent earnings are truly unprecedented (I apologize for using this overly used phrase, but it is true when it comes to companies beating expectations). Investors who panicked during the pandemic and got out of the market without redeploying their assets have missed out on great year thus far.

Sources

1. https://health-infobase.canada.ca/covid-19/epidemiological-summary-covid-19-cases.html

2. who.int/en/activities/tracking-SARS-CoV-2-variants

4. https://health-infobase.canada.ca/covid-19/vaccination-coverage/

5. https://covid.cdc.gov/covid-data-tracker/#vaccinations_vacc-total-admin-rate-total

6. https://www.reuters.com/world/us/astrazeneca-files-us-approval-drug-prevent-covid-19-2021-10-05/

8. federalreserve.gov/monetarypolicy/files/FOMC_LongerRunGoals.PDF

11.https://secure.ubs.com/campaignwebApp/view/OnlineVersion?id=%40%2Bz2AKJRjoxFmE2jKL1G8vA%3D%3D&c=%401EeIpFEaVmvONTIGj%2FJoxsmGpq7YC2oAVRAQ8phzJxs%3D&did=%40gNGDVlGyStW1IPD8mNypCQ%3D%3D&campID=UC%3AE%3A601227%3A601241%3A269449152%3A0%3A821449752%3A821449754%3Aen%3A658203216%3A%3A%3A

12. https://www.bloomberg.com/news/articles/2021-09-15/inflation-jumps-to-4-1-in-canada-jolting-trudeau-election-bid?srnd=premium-canada&sref=IAvzeH47

DISCLAIMER: This newsletter is solely the work of the author for the purpose to provide information only. Although the author is a registered Investment as a Portfolio Manager at ZLC Wealth Inc. (ZLCWI), this is not an official publication of ZLCWI. The views (including any recommendations) expressed in this newsletter are those of the author alone, and are not necessarily those of ZLC Wealth Inc. The information contained in this newsletter is drawn from sources believed to be reliable, but the accuracy and completeness of the information is not guaranteed, nor in providing it does the author or ZLCWI assume any liability. This information is not to be construed as investment advice. Your own circumstances have been considered properly and that action is taken on the latest available information. This newsletter is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This information is given as of the date appearing on this newsletter, and neither the author nor ZLCWI assume any obligation to update the information or advise on further developments relating to information provided herein. This newsletter is intended for distribution in those jurisdictions where both the author and ZLCWI are registered to do business. Any distribution or dissemination of this newsletter in any other jurisdictions is prohibited. The rate of return shown is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of the Fund or returns on investment in the Fund. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the offering memorandum or prospectus of the Fund before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Performance results are not guaranteed, values may change frequently, and past performance may not be repeated. I

IMPORTANT INFORMATION: The above commentary may contain an update on certain funds offered through ZLC Wealth Inc. Returns are net of fees and include reinvested dividends. The performance of the fund presented in this document may be for a different series of fund than the series that you hold in your account. The performance of the series that you hold may be different than what is shown. This information does not constitute an offer or solicitation to anyone in any jurisdiction in which such an offer or solicitation is not authorized, or to any person to whom it is unlawful to make such an offer or solicitation. These products may not be appropriate for all investors. Important information about the funds is contained in the offering documents which should be read carefully before investing. You can obtain these documents from ZLC Wealth Inc. Please speak to a ZLC Wealth Portfolio Manager or Representative to determine if these products are right for you.