By Jon McKinney

President & Portfolio Manager

President’s Letter Q2- 2025

Daring Greatly

I was reviewing the portfolio of a client the other day who is not a fan of Trump and, by extension, no longer a fan of America. He suggested we sell all our US stocks. This client says Trump’s lack of morality will erode U.S. exceptionalism, ultimately slowing economic growth and weighing on stock values.. I’m not sure he is right (about slowing US growth; perhaps not about Trump’s morality, but I’ll leave that alone).

While a recession is never out of the question, the US continues to be the epicenter of business growth. Its economy is now $30 trillion and growing, (Canada’s economy is $2.4 trillion) and it is the centre of key growing industries like artificial intelligence and military manufacturing (sadly a growth area now).

We always seem to live with the risk of a recession, but the issue for us is not a recession – we will have one at some point – but whether we can grow our investment assets over the years to come, recession or not. To protect growth, the key is to have a portfolio appropriately diversified by company, sector, region and asset class. Generally, our portfolios have US equities (key driver of our returns in 2023 and 2024), Canadian equities (very strong recently), and global equities (strong lately and arguably undervalued), as well as bonds (good yield and defensive) and hedged alternative investments (also defensive).

Daring greatly is not how we build portfolios. Instead, we use our best thinking to diversify. For investors “daring greatly” might mean 100% US equities, or 100% the big tech stocks, or even 100% Nvidia which surpassed $4,000,000,000,000 in value this month. Daring greatly might be a brilliant philosophy for personal growth, but it is not our guide when building portfolios.

By the way, Daring Greatly is the title of a book by Brene Brown that my wife recommended to me. You might find it interesting that Brown chose her title from a famous Teddy Roosevelt quote:

“It is not the critic who counts; not the man who points out how the strong man stumbles, or where the doer of deeds could have done them better. The credit belongs to the man who is actually in the arena, whose face is marred by dust and sweat and blood; who strives valiantly; who errs, who comes short again and again, because there is no effort without error and shortcoming; but who does actually strive to do the deeds; who knows great enthusiasms, the great devotions; who spends himself in a worthy cause; who at the best knows in the end the triumph of high achievement, and who at the worst, if he fails, at least fails while daring greatly, so that his place shall never be with those cold and timid souls who neither know victory nor defeat.”

Daring greatly may be motivational in life, but it is not how we build portfolios.

A philosophy that is closer to our approach is Mel Robbins and her “let them” theory. In fact, to those who dare greatly with their portfolios we say, “let them”.

Let Them

Let Them is another book recommended by my wife. The author Mel Robbins explains her “let them” philosophy by telling a story about her son’s prom.

Her two older daughters had obsessed over all the details of their proms but her son wasn’t even sure he was going to go. A week before the prom he decides to go and they scramble around arranging his tux, date, location and so on. On the prom day, her son and some of the other graduates took some pictures and just when they were going to head out it started to rain. It wasn’t in the forecast so no one had coats or umbrellas. Hair would be a mess and they would all get soaked.

The kids didn’t seem to care. They were all heading on foot to a local taco place but they didn’t have any reservations and the place is small. So, to the irritation of the kids, Mel started trying to book seats at other restaurants. That’s when Mel’s older daughter grabbed her by the arm and said:

“If Oakley and his friends want to go to a taco bar for pre-prom, LET THEM.”

“But its too small for all of them to fit into; they’re going to get soaked.”

“Mom LET THEM get soaked.”

“But his new sneakers are going to get ruined.”

“LET THEM get ruined.”

The LET THEM philosophy frees you from others’ opinions, drama, and control, empowering you to focus on your own happiness and growth.

What does this have to do with investing. Well, a lot. As investors we are often told we are missing something. We have FOMO – fear of missing out. We’re told we should have gold, or Chinese stocks, cannabis, Tesla or Bitcoin. Some of these have done well some may still do well. We get it, but we still hold to our principles.

Dot-Com FOMO

FOMO can affect professional investment mangers as well.

A fund manager I worked for many years ago always loved to tell the story of his portfolio in the late 1990s. As a value investor he included no tech companies in his portfolio, because he couldn’t get his head around their valuation. At his annual client update he would face nasty comments from his investors about his lack of “dot-com” investments that were pushing the tech-heavy NASDAQ index to new highs daily. Between 1995 and its peak in March 2000, it rose 80%! But as we all now know in retrospect, those dot-com values were artificial and by October of 2002, all gains were given back. The NASDAQ dropped 78% and my manager looked like a hero.

He knew many managers were buying dot-com companies and many clients had FOMO but he said, “let them”. He remained true to the guiding principles he followed for managing client portfolios.

Market Update

Below is a review of the market trends in the second quarter prepared by Yin Chan, CFA, our Investment Analyst.

The Q2 of 2025 was marked by uncertainty, growing divergence in monetary policies, and persistent geopolitical tensions. While inflation metrics in both Canada and the U.S. have eased steadily, they remain above target, prompting central banks to strike a careful balance between tightening and support. At the same time, uneven growth across regions, fluctuating bond yields, and a cooling but still-stretched housing market have added layers of complexity to the investment landscape.

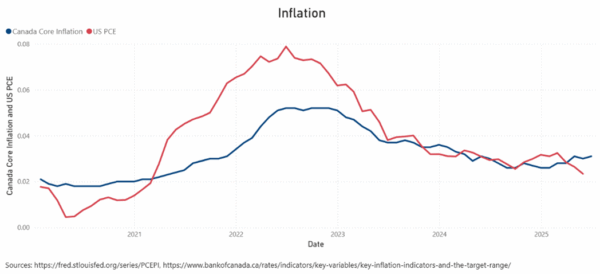

Canada’s core inflation measures, the CPI-median at 3.1% in June, and the U.S. PCE Price Index at 2.34% in May, have both eased steadily from peak. This indicates that monetary tightening is effectively bringing inflation closer to target in both countries. However, the Canadian core inflation remains above the 2% target, reflecting the stickiness of the current environment. Although the Bank of Canada has cut rates more aggressively than the Fed since late 2024, the Canadian market remains relatively softer than the U.S. As a result, we continue to expect further rate cuts later this year. The recent decision by both central banks to hold rates is likely temporary, assuming inflation continues its downward trend.

Geopolitical tensions continue to rise. Conflicts in the Middle East and the ongoing war in Ukraine have intensified. This global landscape is contributing to diverging monetary policies, as advanced economies gradually ease while emerging markets remain constrained by inflation and external vulnerabilities. These are likely to persist and reinforce the importance of being globally diversified, particularly in periods of macroeconomic realignment.

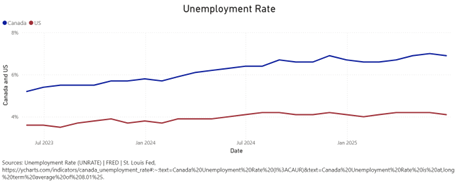

In June 2025, Canada’s unemployment rate has dropped to 6.9% from 7%, while U.S. unemployment remains stable around 4.1%. This comparative difference shows that Canadian markets are significantly weaker and require more support for businesses. It could be a supporting evidence for the BOC’s next interest rate cuts, potentially bringing more stimulus to the market. However, softness in the domestic labor market must be weighed alongside international pressures, especially in an increasingly bifurcated recovery.

Over a 1-year period, the Canadian equity market has significantly outperformed, showing a steady upward trend with strong momentum into mid-2025. In contrast, the U.S. equity market experienced more volatility but remained relatively flat since early 2025. Meanwhile, the MSCI EAFE Index, which tracks developed markets outside of North America, was relatively less correlated throughout the period, reflecting global economic pressures and geopolitical instability. This divergence across regions underscores the need for a thoughtfully constructed, all-weather portfolio to capture the upside while managing downside risks.

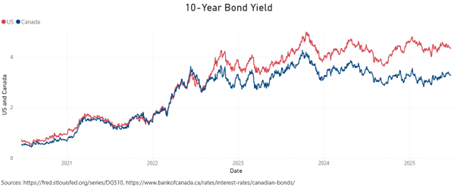

Bond yields have been fluctuating, with Canada trending lower, as the market anticipates future rate cuts amid cooling inflation and softer economic conditions. The persistent spread between U.S. and Canadian yields may influence capital flows and currency dynamics.

In this environment, short-term signals often conflict with long-term objectives. That’s why we continue to emphasize a disciplined, diversified investment approach that is built to navigate uncertainty, withstand volatility, and seek opportunities across cycles.

Looking forward, the road ahead remains complex. With uneven growth, regional divergences, and continued geopolitical uncertainty, we believe that a diversified, well-constructed portfolio, grounded in investment analysis and risk discipline, is essential. Our all-weather approach continues to focus on resilient positioning, combining asset classes, sectors, and geographies that can adapt across cycles. This ensures that we are not only prepared for the current environment but also positioned for what may come next.

Sources:

1. https://fred.stlouisfed.org/series/PCEPI

2. https://www.bankofcanada.ca/rates/indicators/key-variables/key-inflation-indicators-and-the-target-range/

3. https://fred.stlouisfed.org/series/UNRATE

4. https://ycharts.com/indicators/canada_unemployment_rate

5. https://ca.investing.com/indices/msci-eafe-historical-data

6. https://www.spglobal.com/spdji/en/indices/equity/sp-500/

7. https://www.spglobal.com/spdji/en/indices/equity/sp-tsx-composite-index/

8. https://fred.stlouisfed.org/series/DGS10

9. https://www.bankofcanada.ca/rates/interest-rates/canadian-bonds/

Disclaimer:

This newsletter is solely the work of the author for the purpose to provide information only. Although the author is a registered Investment as a Portfolio Manager at ZLC Wealth Inc. (ZLCWI), this is not an official publication of ZLCWI. The views (including any recommendations) expressed in this newsletter are those of the author alone, and are not necessarily those of ZLC Wealth Inc. The information contained in this newsletter is drawn from sources believed to be reliable, but the accuracy and completeness of the information is not guaranteed, nor in providing it does the author or ZLCWI assume any liability. This information is not to be construed as investment advice. Your own circumstances have been considered properly and that action is taken on the latest available information. This newsletter is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This information is given as of the date appearing on this newsletter, and neither the author nor ZLCWI assume any obligation to update the information or advise on further developments relating to information provided herein. This newsletter is intended for distribution in those jurisdictions where both the author and ZLCWI are registered to do business. Any distribution or dissemination of this newsletter in any other jurisdictions is prohibited. The rate of return shown is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of the Fund or returns on investment in the Fund. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the offering memorandum or prospectus of the Fund before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Performance results are not guaranteed, values may change frequently, and past performance may not be repeated.

IMPORTANT INFORMATION: The above commentary may contain an update on certain funds offered through ZLC Wealth Inc. Returns are net of fees and include reinvested dividends. The performance of the fund presented in this document may be for a different series of fund than the series that you hold in your account. The performance of the series that you hold may be different than what is shown. This information does not constitute an offer or solicitation to anyone in any jurisdiction in which such an offer or solicitation is not authorized, or to any person to whom it is unlawful to make such an offer or solicitation. These products may not be appropriate for all investors. Important information about the funds is contained in the offering documents which should be read carefully before investing. You can obtain these documents from ZLC Wealth Inc. Please speak to a ZLC Wealth Portfolio Manager or Representative to determine if these products are right for you.