A Letter from the President:

Inflation is not so “transitory”

The June U.S. inflation rate came in at 9.1%, higher than the 8.8% economists expected 1, worse than the May reading of 8.6%, and the largest 12-month rate since 1981 2. In 2021 inflation was called “transitory”, but in 2022 it appears to be not so transitory 3. Inflation is now a problem.

Tiff Macklem, Governor of the Bank of Canada, announced a surprise 1% hike in the Bank of Canada discount rate to 2.5% this month 4, a move that caused the Canadian banks to move their prime rates from 3.7% to 4.7%. Only a year ago the Canadian Prime was 2.45% 5. The Fed will move next at its meeting in late July, with an expected increase of 0.75% or maybe 1%. A 1% move has never been done since Fed started directly using overnight interest rates to conduct monetary policy in the early 1990s.6

Continued tightening is also expected from Andrew Bailey, Governor of the Bank of England, at their next meeting in August and following five increments since December. The inflation reading in the UK is 9.1% based on May data but some think it could peak at 11% before beginning the climb down.7

CATCHING UP

So it seems that all of sudden the central banks are concerned about inflation and they are making extraordinary interest rate moves. In fact, many economists have been very critical of the central banks for allowing inflation to get out of hand. I can’t speak for the central bankers, but I think we can be pretty sure that:

1. Central banks don’t like inflation and they would not do anything to cause it unnecessarily,

2. The banks have teams of economists who do nothing but try to predict inflation, and

3. The banks were “not asleep at the switch”

The banks underestimated the inflation this year and are now trying to catch up. But let’s not forget we had a significant outbreak of Omicron Covid in January, China’s Zero-Covid policy was negatively impacting global distribution and the world economy (and it still is), and no one was expecting Russia would invade its free and democratic neighbour which added significant pressure on energy and food inflation. The point is this, it is very hard to know what lies ahead. Even the best and the brightest don’t have crystal balls. We don’t!

OUR JOB

Our job is to be your portfolio manager. You rely on us to manage your wealth. It’s why you pay us. So, you might ask why we didn’t see this bear market coming? The answer is we did see it coming. Everyone saw it coming. We just didn’t know when. Recessions and bear markets are just part of the normal cycle of markets. Some say bear markets are the cost of admission to the growth benefits of equity ownership. The problem is we don’t know when they will arise and, in our view, it is always better to keep our money invested and working for us.

It’s the safest way to grow assets in the long run.

“Buy American, I am”

On October 16, 2008, in the heart of the great recession and one month after Lehman Brothers filed for bankruptcy protection, Warren Buffet wrote an opinion piece in the New York Times titled “Buy American. I am.” Markets at the time were in a tailspin and the economy was faltering when Buffet wrote:

“A simple rule dictates my buying: Be fearful when others are greedy, and be greedy when others are fearful. And most certainly, fear is now widespread, gripping even seasoned investors. To be sure, investors are right to be wary of highly leveraged entities or businesses in weak competitive positions. But fears regarding the long-term prosperity of the nation’s many sound companies make no sense. These businesses will indeed suffer earnings hiccups, as they always have. But most major companies will be setting new profit records 5, 10, and 20 years from now. Let me be clear on one point: I can’t predict the short-term movements of the stock market. I haven’t the faintest idea as to whether stocks will be higher or lower a month or a year from now. What is likely, however, is that the market will move higher, perhaps substantially so, well before either sentiment or the economy turns up. So if you wait for the robins, spring will be over.”

Buffet’s message was early – the market dropped significantly after he wrote this piece, bottoming on March 9, 2009 – but the message was right. Stay invested; keep to your plan.

Our portfolios did very well in 2021, and I want to emphasize that using our approach to building rational, diversified, balanced portfolios, with an allocation to bonds, real estate, and well-thought-out alternatives that hedge out risk, has delivered results that beat the benchmarks.

– Jon McKinney, President and Portfolio Manager

Sources:

1 Domm, P. (2022, July 12) Consumer inflation is expected to have been even hotter in June, but it could be peaking. CNBC, Retrieved from: https://www.cnbc.com/2022/07/12/consumer-inflation-is-expected-to-have-been-even-hotter-in-june-but-it-could-be-peaking.html

2 Cox, J. (2022, June 10) Inflation rose 8.6%in May, highest since 1981. CNBC, Retrieved from: https://www.cnbc.com/2022/06/10/consumer-price-index-may-2022.html

3 Board of Governors of the Federal Reserve System (2021, November 3) Federal Reserve issues FOMC statement. Retrieved from: https://www.federalreserve.gov/newsevents/pressreleases/monetary20211103a.htm

4 Media Relatoins (2022, July 13) Bank of Canada increases policy interest rate by 100 basis points, continues quantitative tightening. Bank of Canada, Retrieved from: https://www.bankofcanada.ca/2022/07/fad-press-release-2022-07-13/

5 Augustin, M.; Da Silva, M.; & Subdhan, A. (2022, July 13), How does the Bank of Canada’s interest rate hike affect variable rate mortgages?, The Globe and Mail, Retrieved from: https://www.theglobeandmail.com/business/article-interest-rates-variable-mortgage-explained/

6 Rugaber, C. (2022, July 15). Federal Reserve Board member opens door to 1-point hike. Advisor’s Edge. Retrieved July 19, 2022, from https://www.advisor.ca/news/economic/federal-reserve-board-member-opens-door-to-1-point-hike/

7 Partington, R. & Mason, R. (2022, June 22) UK inflation rises to 9.1%, its highest rate in 40 years, The Guardian, Retrieved from: https://www.theguardian.com/business/2022/jun/22/uk-inflation-rises-to-91-its-highest-rate-in-40-years

Gareth’s Investment Letter: Q2 2022 Review

Financial markets continued to struggle in the second quarter of 2022 with ongoing inflation concerns, central banks hiking interest rates aggressively, and fears of a slowdown in economic growth. During Q2, we entered bear market territory in several of the main stock market indices, down more than 20% from their January highs earlier this year. The primary U.S. stock market index, the S&P 500, had its worst first half of the year in over 50 years.1 Even the bond market hasn’t been able to hide and has been under pressure from rising interest rates. The rapid spike in interest rates has brought down the valuations of many large tech companies that have previously benefited from the low-rate environment. Investors have shifted away from growth-oriented areas of the market in favour of value.

Despite the turbulence in the markets, Canada’s unemployment rate fell to the lowest level since 1976 and, as of May, sits at 5.1%.2 Inflation in the U.S. hit a 40-year high recently as the consumer price index increased 8.6% from a year prior and rose 1% from a month earlier, which topped analyst estimates.3

TAKE A HIKE

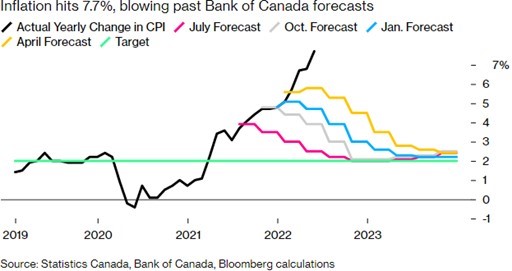

As widely expected, The Federal Reserve (Fed) in the U.S. voted unanimously to increase the benchmark rate by half a percentage point at their May meeting, which was the biggest interest-rate increase since 2000. The Fed recognized that inflation is too high and will need to move to bring it back down. They decided to one-up their previous meeting when on June 15th, they raised the benchmark interest rate by a further 75 basis points, which was the biggest increase since 1994.4 Inflation in Canada has been on a similar trajectory to our Southern neighbours; Annual inflation rose to 7.7% in May, which means that the cost of living is increasing at twice the average wage gains in the country, adding a potential headwind to the economy. Actual inflation numbers have been much higher than previous forecasts, which can be visualized in the graphic below.5

The Bank of Canada increasing interest rates will have many implications, one of which is in the Canadian housing market. From April to May 2022, benchmark prices in Canada fell 0.8%, and home sales dropped 8.6%. Prospective home buyers will no doubt be relieved to see these most recent figures; however, prices are still up 19.8% from the year before and still out of reach for many Canadians.6 Record low-interest rates have been helping to fuel the fire of increasing housing prices, and the rate hikes that are still to come will remove some, but not all that stimulus. Even with the slight cooling off thus far in the housing market, RBC economist Robert Hogue notes that even as market sentiment sours it’s unlikely to morph into a meltdown, and positive demographic factors will provide a safety net against a hard landing for the Canadian housing market.7

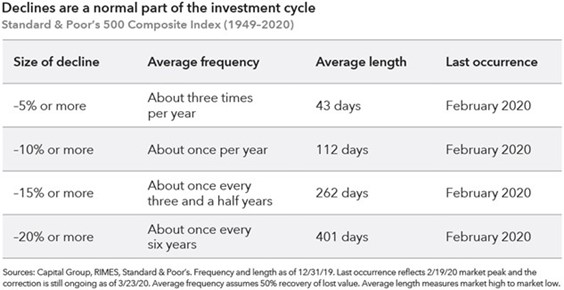

The chart below depicts how declines are a normal part of the investment cycle. Since the Great Depression began in 1929, every decade has had notable declines in the S&P 500. Additionally, in every case, the five years following those declines have delivered, on average, positive returns.8

WHAT GOES UP MUST COME DOWN

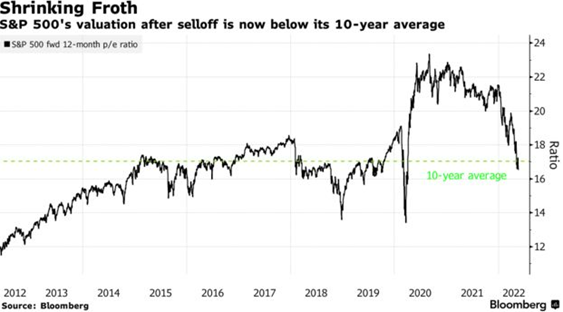

With equities struggling this year, we have seen valuations come down closer to their ten-year average, but that isn’t to say they have bottomed yet.9 One reason is that there is the risk of margins decreasing for corporations as higher labour costs and high energy prices eat into profits. If companies in general struggle to pass on higher costs to consumers, this puts downward pressure on margins. Because services are paramount in the economy, as consumers switch to spending more of their income on services rather than consumer goods, it will help the economy. However, given the S&P 500, for example, is split between services and goods, this rotation may not be supportive of equity prices. An earnings reduction is likely priced into the market already; thus, a market rally could be propounded, assuming the slowdown is not as great as the market is anticipating.10

KEEP CALM AND CARRY ONE

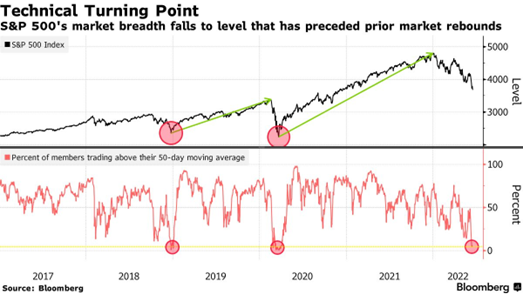

According to Bloomberg, the percentage of S&P 500 members trading above their 50-day moving average sank below 5% during the week of June 15th, the lowest level since Covid-19 fears battered stocks more than two years ago. Both that selloff and the one in late 2018 reversed course shortly after seeing a similar share of stocks dip below the closely watched technical average.11 Some analysts view this as a positive sign that equity markets could be on the rise soon.

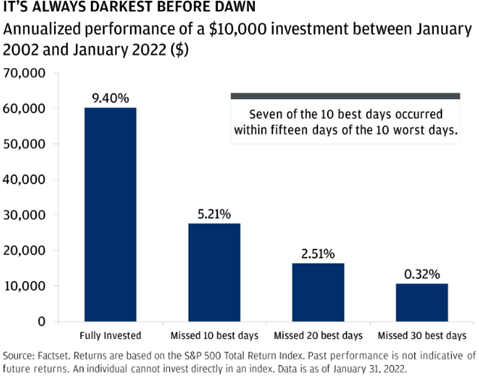

The chart below illustrates what would have happened if an investor missed the 10 single best days in the S&P 500 over the past 20 years. If missing the 10 best days sounds implausible to you, consider that in the past 20 years, seven of those best days happened within just about two weeks of the 10 worst days.12 Many investors are aware of the benefits of staying invested during market downturns, but emotions can at times, get the better of them when they decide to sell when the going gets tough rather than stick to their long-term investment plan.

Please send Questions or Comments

If you have questions or comments, please feel free to contact any member of the ZLC Wealth service team:

- Jon McKinney, or Tom Suggitt (Portfolio Managers),

- Garry Zlotnik (CEO, & Representative),

- Grace Domingo (VP of Administration),

- Mark van Koll (Compliance Manager)

- Lisa Der (Account Manager) or

- Gareth Langdon (Investment Analyst)

We’re here to help in any way we can.

Kind regards,

Recourses:

1. Cox, J. (2022, June 30). The market’s worst first half in 50 years has all come down to inflation. CNBC. Retrieved from https://www.cnbc.com/2022/06/30/the-markets-worst-first-half-in-50-years-has-all-come-down-to-one-thing.html

2. Argitis, T. (2022, June 10). Jobless Rate Hits New Record Low in Canada, Wages Accelerate. Bloomberg. Retrieved from https://www.bloomberg.com/news/articles/2022-06-10/canada-jobless-rate-drops-to-new-record-low-wages-accelerate

3. Rockeman, O. (2022, June 10). US Inflation Quickens to 40-Year high, Pressuring Fed and Biden. Retrieved from https://www.bloomberg.com/news/articles/2022-06-10/us-inflation-unexpectedly-accelerates-to-40-year-high-of-8-6

4. Torres, C. & Boesler, M. (2022, June 15). Fed Hikes 75 Basis Points; Powell Says 75 or 50 Likely in July. Retrieved from https://www.bloomberg.com/news/articles/2022-06-15/fed-hikes-rates-75-basis-points-intensifying-inflation-fight?srnd=premium-canada

5. Argitis, T. (2022, June 10). Inflation Surges to 7.7% in Canada, Fastest Pace Since 1983. Bloomberg. Retrieved from https://www.bloomberg.com/news/articles/2022-06-22/canadian-inflation-rate-hits-7-7-fastest-pace-since-1983

6. Canadian Real Estate Association. (2022, June 15). National Statistics – Canadian home sales slow again in May. CREA. Retrieved from: https://creastats.crea.ca/en-CA/

7. Haven, P. (2022, June 16). Posthaste: Canada’s Housing Correction Has Started – What’s surprising is its speed. Financial Post. Retrieved from: https://financialpost.com/executive/executive-summary/posthaste-canadas-housing-correction-has-started-whats-surprising-is-its-speed

8. Capital Group (2002). How long will this bear market last? Retrieved from: https://www.capitalgroup.com/advisor/tools/guide-to-market-volatility/guides/how-long-will-this-last.html

9. Jaisinghani, S., Mookerjee, I. & Vishnoi, A. (2022, May 19) Goldman, JPMorgan Strategists See Recession Fears as Overblown. Bloomberg. Retrieved from: https://www.bloomberg.com/news/articles/2022-05-19/goldman-s-kostin-says-stocks-pricing-elevated-odds-of-recession?srnd=premium-canada

10. Li, W., Vivek, P., Gill, N. & Reiman, K. (2022, June 13) Why we’re not buying the dip in stocks. BlackRock. Retrieved from: https://www.blackrock.com/corporate/literature/market-commentary/weekly-investment-commentary-en-us-20220613-why-were-not-buying-the-dip-in-stocks.pdf

11. Nazareth, R. (2022, June 15). Stocks Get Crushed With Recession Worries Mounting. Bloomberg. Retrieved From: https://www.bloomberg.com/news/articles/2022-06-15/stocks-bonds-lifted-as-powell-says-big-hikes-rare-markets-wrap?srnd=premium-canada

12. Ausenbaugh, E. (2022, February 18). The case for (always) staying invested. J.P.Morgan Wealth Management. Retrieved from: https://www.jpmorgan.com/wealth-management/wealth-partners/insights/the-case-for-always-staying-invested

13. Rattner, N. & Li, M. (2022, June 14). How the S&P 500 Performs After Closing in a Bear Market. The Wall Street Journal. Retrieved from: https://www.wsj.com/livecoverage/stock-market-today-dow-jones-bitcoin-fed-rates-06-14-2022/card/howthe-s-p-500-performs-after-closing-in-a-bear-market-yBwgfJwW8HGSNJaKg6LB

DISCLAIMER: This newsletter is solely the work of the author for the purpose to provide information only. Although the author is a registered Investment as a Portfolio Manager at ZLC Wealth Inc. (ZLCWI), this is not an official publication of ZLCWI. The views (including any recommendations) expressed in this newsletter are those of the author alone, and are not necessarily those of ZLC Wealth Inc. The information contained in this newsletter is drawn from sources believed to be reliable, but the accuracy and completeness of the information is not guaranteed, nor in providing it does the author or ZLCWI assume any liability. This information is not to be construed as investment advice. Your own circumstances have been considered properly and that action is taken on the latest available information. This newsletter is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This information is given as of the date appearing on this newsletter, and neither the author nor ZLCWI assume any obligation to update the information or advise on further developments relating to information provided herein. This newsletter is intended for distribution in those jurisdictions where both the author and ZLCWI are registered to do business. Any distribution or dissemination of this newsletter in any other jurisdictions is prohibited. The rate of return shown is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of the Fund or returns on investment in the Fund. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the offering memorandum or prospectus of the Fund before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Performance results are not guaranteed, values may change frequently, and past performance may not be repeated. I

IMPORTANT INFORMATION: The above commentary may contain an update on certain funds offered through ZLC Wealth Inc. Returns are net of fees and include reinvested dividends. The performance of the fund presented in this document may be for a different series of fund than the series that you hold in your account. The performance of the series that you hold may be different than what is shown. This information does not constitute an offer or solicitation to anyone in any jurisdiction in which such an offer or solicitation is not authorized, or to any person to whom it is unlawful to make such an offer or solicitation. These products may not be appropriate for all investors. Important information about the funds is contained in the offering documents which should be read carefully before investing. You can obtain these documents from ZLC Wealth Inc. Please speak to a ZLC Wealth Portfolio Manager or Representative to determine if these products are right for you.