Letter from the President:

On March 16 last year the S&P 500 had dropped as low as 2,300; today its 4,400. Covid shut the economy down in March 2020, but before the month was over, investors saw the signs that we would move through this epidemic and the buying started. 2020 turned out to be a good year for financial markets, the S&P 500 was up 16.3%, and 2021, at least to the end of July, is strong as well. Growth in our portfolios showed us again that investors should focus on “time in the market, not timing the market”, to steal the quote attributed to Keith Banks of Bank of America. Time in the market pays off for long-term investors like you and me.

Long before Covid, the team at ZLC Wealth did a great deal of work in designing portfolios that would take advantage of growth while providing our clients with proper diversification. In fact, notwithstanding the dramatic social, health, and economic events of 2020 and now 2021, ZLC Wealth has been doing well. In fact, we recently hired a bright new member of the team, Gareth Langdon. Gareth is a soccer player, he played on the varsity team at the University of Victoria, and is pursuing his CFA designation including recently sitting for the Level III Exam. We are happy to have him.

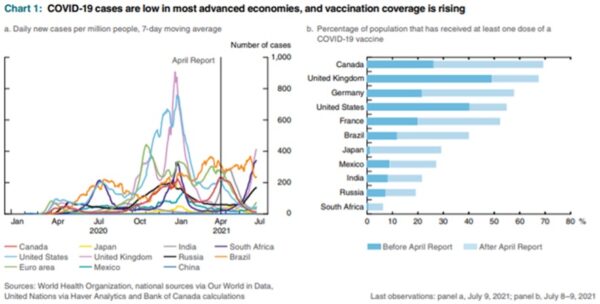

Covid is not gone. As I write this there are many covid concerns around the world – Australia, Africa, low vaccine US states, Kelowna and even Tokyo as it hosts the Olympics – but for investors the big issue today is inflation. Inflation drives interest rates and rates drive values. Gareth takes a more detailed look below in his first contribution to our “President’s letter”.

INFLATION: WHAT GOES UP, MUST COME DOWN, RIGHT?

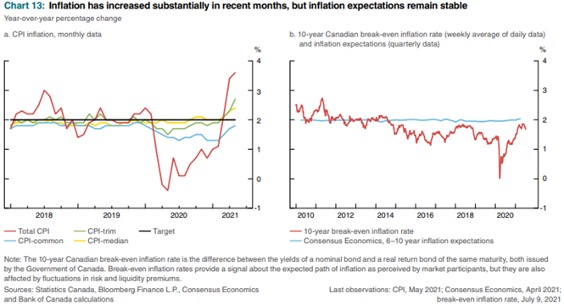

Inflation has been taking over the financial headlines the past few months and rightly so; the direction of inflation can and will have significant impacts on monetary policy which in turn impacts financial markets both here in Canada and globally. Some folks believe inflation will run out of control and force central banks to hike interest rates much sooner than the consensus in order to cool down the economy, while others believe the inflation we have seen thus far is transitory and will subside once the supply side starts to better keep up with the pent-up demand which will eventually cool off as well. The Bank of Canada just released their latest Monetary Policy Report and to give you some context, the first title in the report is titled “Canada’s inflation-control strategy” which highlights the importance of inflation and how the direction it takes can have a huge impact on the pace of the post pandemic recovery.

Whichever camp you might fall into when it comes to inflation expectations, it is important to remember that by having a diversified portfolio with asset classes having different sensitivities to inflation helps long term investors weather any spikes in inflation that may occur. However, what did surprise many including myself was the decline in the Canadian 10 Year Benchmark Bond Yield during the second quarter. Is the bond market telling us we are getting a little carried away?

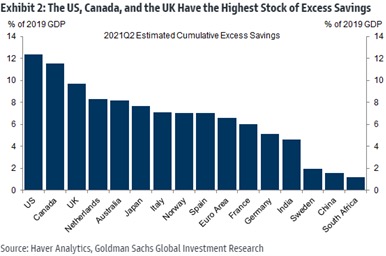

Party like its 1999: During the peak of the pandemic and still to this day many Canadians and individuals from around the world have struggled financially as a result of losing their jobs through the pandemic. On the other hand, many workers were able to successfully work from home while they saw their savings increase as a result of the lockdowns and nowhere to spend their money except purchasing things they didn’t really need on Amazon or try to become day traders by becoming experts on meme stocks. As a result of the amazing efforts by our healthcare workers here in British Columbia and the successful vaccine rollout, we have seen an easing of restrictions and as a result an opening of the local economy. This reopening allowed for the ZLC Foundation’s 35th Annual Charity Golf Tournament to go ahead which was a huge success and benefited the Easter Seals, British Columbia & Yukon. We look forward to next year’s event and continuing supporting the charity tournament which has distributed over $1,417,000 to the beneficiaries of the Foundation.

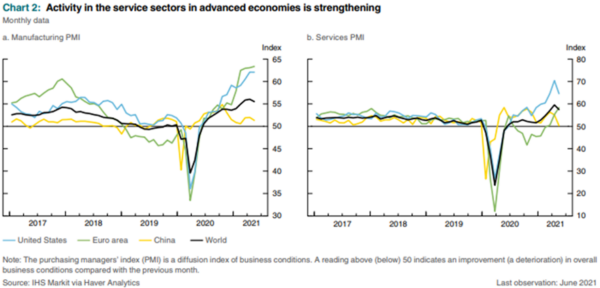

On a personal note, I cannot remember the last time I spent as much money in the past couple of months on dining out, booking future travel plans, and the list goes on and on. It seems like everyone I talk to is doing the same: spending the cash they have been sitting on for what felt like an eternity. Canada just announced that fully vaccinated U.S. residents will be allowed into Canada as of August 9th. As of September 7th, travelers from other countries will join the Americans onto our soil if they fulfil the requirements to enter our borders. This incoming influx of foreign visitors looking to spend their cash could be the catalyst to continue supporting the service sector that was hit the hardest during the pandemic.

The below survey is a great illustration of the attitudes of many Canadians – as the chart shows those surveyed expect their spending to increase once they had received their COVID-19 vaccine which would be a boost to corporate earnings and equity markets in general in Canada.

Over the past few months oil demand has been strong which can be seen below, and with the reopening of major economies around the world we could see prices rise further by the end of the year. More recently we have seen a pullback in the commodities space as recent fears about the recovery losing steam has emerged.

This in turn has helped the Canadian dollar appreciate, as well as CAD being a risk on, and commodity tied currency.

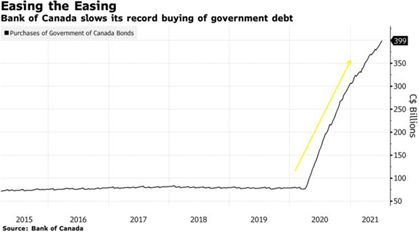

Outlook for the rest of the year: We are halfway through what has been an interesting year to say the least and have seen strong performance by global risk assets even though economic data has been mixed at times. More recently the Bank of Canada has removed stimulus by tapering their weekly purchasing of government debt from $3 billion to $2 billion which is a promising sign for the Canadian economy. However, there remains a lot of uncertainty as there are risks, some of which are known, and some that are not. Some of the known risks are another wave of infections, more persistent supply bottlenecks and cost pressures, weaker Canadian exports, and a more pronounced slowing of the Canadian economy. The pace of growth we have seen recently cannot go on forever as stimulus will ease over time and record low interest rates will eventually bump higher. However, with low current interest rates, a vaccinated population who are itching to get out and spend their savings, the party may continue for a while yet.

Keep calm and carry on: Even though future market pull backs and potential inflation worries could cause short term pain in financial markets, we continue to take a long-term holistic approach to portfolio management and not try to time the market and specifically the timing of macroeconomic variables. With a mix of financial headlines focusing on the latest news of the Corona virus and the post pandemic recovery expectations, it can be easy to get overwhelmed with investing decisions and portfolio strategies. One week value stocks might be the rage, then growth is back in favour when reading the mainstream financial media. With many uncertainties on the path of monetary and fiscal policy and reopening of the global economy, market volatility is expected as well as pullbacks which we have already seen at the beginning of the third quarter. Having a diversified portfolio, being patient, and staying invested, can help you stick to your long-term investment goals.

Our Principles

Here again are the ZLC Wealth principles of good investing:

- Diversify appropriately: A mix of asset classes reduces the risk of loss.

- Invest with conviction: Use relatively few managers that are concentrated.

- Include small and mid-sized companies: They often fly under the radar.

- Have a value style bias: Invest like a business owner, not a speculator.

- Don’t overlook alternatives: These are often neglected by retail investors.

- Keep core fixed income conservative: Don’t reach too high for yield

We are passionate about building portfolios designed for each of our client’s investment objectives and risk tolerance. We take a long-term view, have reasonable diversification across strategies and holdings, favor value style, and invest rationally, not emotionally.

Sources:

https://www.bankofcanada.ca/2021/07/mpr-2021-07-14/

https://www.bankofcanada.ca/2021/07/mpr-2021-07-14/https://www.bnnbloomberg.ca/canada-sets-aug-9-border-opening-for-vaccinated-u-s-visitors-1.1630643

DISCLAIMER: This newsletter is solely the work of the author for the purpose to provide information only. Although the author is a registered Investment as a Portfolio Manager at ZLC Wealth Inc. (ZLCWI), this is not an official publication of ZLCWI. The views (including any recommendations) expressed in this newsletter are those of the author alone, and are not necessarily those of ZLC Wealth Inc. The information contained in this newsletter is drawn from sources believed to be reliable, but the accuracy and completeness of the information is not guaranteed, nor in providing it does the author or ZLCWI assume any liability. This information is not to be construed as investment advice. Your own circumstances have been considered properly and that action is taken on the latest available information. This newsletter is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This information is given as of the date appearing on this newsletter, and neither the author nor ZLCWI assume any obligation to update the information or advise on further developments relating to information provided herein. This newsletter is intended for distribution in those jurisdictions where both the author and ZLCWI are registered to do business. Any distribution or dissemination of this newsletter in any other jurisdictions is prohibited. The rate of return shown is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of the Fund or returns on investment in the Fund. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the offering memorandum or prospectus of the Fund before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Performance results are not guaranteed, values may change frequently, and past performance may not be repeated. I

MPORTANT INFORMATION: The above commentary may contain an update on certain funds offered through ZLC Wealth Inc. Returns are net of fees and include reinvested dividends. The performance of the fund presented in this document may be for a different series of fund than the series that you hold in your account. The performance of the series that you hold may be different than what is shown. This information does not constitute an offer or solicitation to anyone in any jurisdiction in which such an offer or solicitation is not authorized, or to any person to whom it is unlawful to make such an offer or solicitation. These products may not be appropriate for all investors. Important information about the funds is contained in the offering documents which should be read carefully before investing. You can obtain these documents from ZLC Wealth Inc. Please speak to a ZLC Wealth Portfolio Manager or Representative to determine if these products are right for you.