By Jon McKinney

President & Portfolio Manager

President’s Letter Q1- 2025

My son called me the other day for advice. The mortgage on his North Vancouver townhouse is open for renewal and he is trying to decide between a fixed rate of 3.85% and a slightly cheaper floating rate of 3.80%. The choice is “fix” and be sure of payments, or “float” and hope for steady or dropping rates over the 5 years. So, naturally he called me. I’m a professional financial advisor, a registered portfolio manager and I’ve been doing this since the 1980s. Who better to ask?

My own first mortgage in 1987 was fixed at 9.75%. A friend was a bond trader at the time and he told me to hold out as long as possible because the rate direction was down. A floating rate would have made more sense, but I fixed it! Maybe it’s only in retrospect, but the direction of interest rates felt more predictable. Today, not so much.

Movements in the Canadian prime rate are tied to the overnight policy rate set by the Bank of Canada and is tied to the conclusions made by Governor Tiff Macklem and the board about both inflationary expectations and the health of the economy. Inflation calls for higher rates; a weak economy calls for lower.

What does Macklem see today? This month he is worried about the economy, but he also fears renewed inflation so he did nothing. The bank rate stays unchanged for now at 2.75%.

There may be times when we have a fairly good idea where rates are going but not today. If I have trouble advising my son on something as “simple” as interest rates, how can I do my job of advising clients about their investments? The reality is nobody knows where rates are going, even if they say they do. I don’t have a crystal ball, and neither does any financial expert. Not even Trump.

On April 3, the S&P500 dropped 4.8%. That’s a loss of about US$2.4 trillion. The next day it dropped 6%, or about US$3 trillion and on April 9 it gained $9.3% or about US$4.6 trillion. These are crazy big numbers. The Canadian Gross Domestic Product or GDP is $2.3 trillion. Who saw this coming? Trump may have had some idea as the moves were spurred by his comments on the direction of tariffs from the Rose Garden or on tweets on X.

Good portfolio managers don’t predict the future. They can’t. Good portfolio managers work with their clients to build smart portfolios that provide a well-thought-out mix of growth and defensive assets – equities, bonds and hedged alternatives. This is what we do know.

Market Update

Markets entered 2025 Q1 on unstable footing. Volatility has returned, and the probability of a sharp S&P 500 drawdown has climbed. Both 3-month and 12-month drawdown probabilities are elevated, which is the levels we typically see in or near recessions. Historically, these spikes have preceded or coincided with economic stress. Today, they reflect concern, not necessarily certainty, but they are hard to ignore.

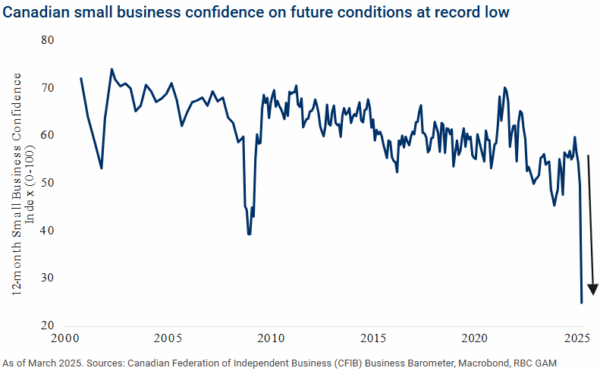

In Canada, bond markets are sending a similar signal. Yields across durations have been sliding for months. Lower yields suggest expectations of weaker growth and more dovish monetary policy. It is supported by one of the clearest indicators of economic sentiment, which is the small business confidence.

As of March 2025, Canadian small business confidence on future conditions has hit a record low. The 12-month outlook index plunged below 40. This is a level that historically signals economic contraction. Business owners are responding to a mix of cost pressures, weak consumer demand, policy uncertainty, and tight financing.

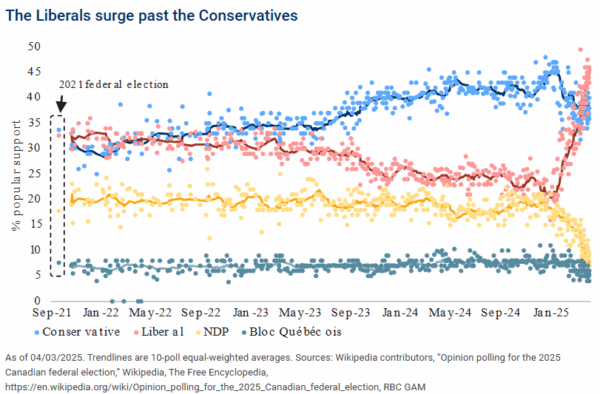

Adding to the uncertainty is the rapidly evolving political landscape. With the federal election approaching, the race between the Conservative and Liberal parties has tightened. Any shift in leadership could alter Canada’s economic direction, especially in terms of fiscal policy, regulation, and taxation.

And then, there’s trade war across the globe where situations change everyday.

The global trade environment remains highly unstable, with tariff policies shifting rapidly and unpredictably. In just the past week, major economies have announced, adjusted, or threatened new tariffs, fueling uncertainty across markets. These constant changes highlight how reactive political trade decisions have become, and how difficult it is for businesses and investors to plan around them. In this kind of environment, it’s even more critical to stay focused on long-term fundamentals and avoid making short-term investment decisions based on headlines.

“Volatility in stock prices doesn’t mean volatility in business value” has become somewhat of a proverb among financial professionals. As history reminds us, successful long-term investing depends on staying focused on the fundamentals. Short-term price swings, whether triggered by interest rates, politics, tariffs, or fear, don’t change the core value of resilient businesses. Markets may overreact but value doesn’t.

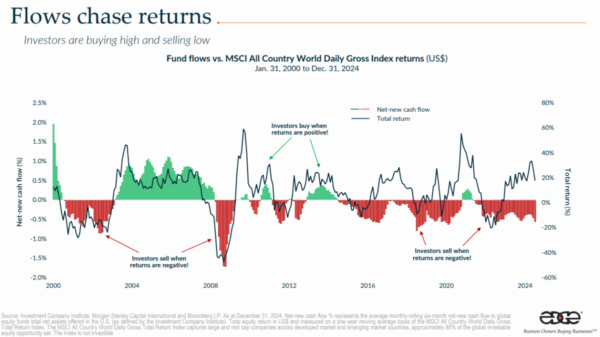

Despite rising market volatility, falling Canadian bond yields, record-low small business confidence, and escalating trade, investors should remain calm. History shows that markets spend far more time in bull markets than bear ones, and that emotional investing often leads to poor outcomes, as shown by the tendency to buy high and sell low. The key is to stay calm, avoid reactive decisions, and invest with a disciplined, professional manager who can navigate short-term noise.

What matters the most is what we have on our hands, not what the market is doing today. The companies in our portfolios have survived shocks well. Their products, risk management, and cash-generating power has been tested by the history. Selling during a storm only guarantees loss. Staying invested means riding out turbulence and participating in the recovery that follows.

Sources:

1. https://www.imf.org/external/datamapper/profile/CAN

2. https://www.goldmansachs.com/insights/articles/how-to-balance-investment-portfolios-as-us-tariffs-rise

3. https://www.bankofcanada.ca/rates/interest-rates/canadian-bonds/

4. https://www.rbcgam.com/en/ca/article/macromemo-march-25-april-7-2025/detail

5. https://www.rbcgam.com/en/ca/article/macromemo-april-8-29-2025/detail

6. https://assets.ctfassets.net/kq9jrkvln56p/4PYGU5QTQsi3XSLykhvZ73/048d0f964b16312f5ac4234da78436b9/Lifeboat_2024.pdf

Disclaimer:

This newsletter is solely the work of the author for the purpose to provide information only. Although the author is a registered Investment as a Portfolio Manager at ZLC Wealth Inc. (ZLCWI), this is not an official publication of ZLCWI. The views (including any recommendations) expressed in this newsletter are those of the author alone, and are not necessarily those of ZLC Wealth Inc. The information contained in this newsletter is drawn from sources believed to be reliable, but the accuracy and completeness of the information is not guaranteed, nor in providing it does the author or ZLCWI assume any liability. This information is not to be construed as investment advice. Your own circumstances have been considered properly and that action is taken on the latest available information. This newsletter is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This information is given as of the date appearing on this newsletter, and neither the author nor ZLCWI assume any obligation to update the information or advise on further developments relating to information provided herein. This newsletter is intended for distribution in those jurisdictions where both the author and ZLCWI are registered to do business. Any distribution or dissemination of this newsletter in any other jurisdictions is prohibited. The rate of return shown is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of the Fund or returns on investment in the Fund. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the offering memorandum or prospectus of the Fund before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Performance results are not guaranteed, values may change frequently, and past performance may not be repeated.

IMPORTANT INFORMATION: The above commentary may contain an update on certain funds offered through ZLC Wealth Inc. Returns are net of fees and include reinvested dividends. The performance of the fund presented in this document may be for a different series of fund than the series that you hold in your account. The performance of the series that you hold may be different than what is shown. This information does not constitute an offer or solicitation to anyone in any jurisdiction in which such an offer or solicitation is not authorized, or to any person to whom it is unlawful to make such an offer or solicitation. These products may not be appropriate for all investors. Important information about the funds is contained in the offering documents which should be read carefully before investing. You can obtain these documents from ZLC Wealth Inc. Please speak to a ZLC Wealth Portfolio Manager or Representative to determine if these products are right for you.