By Jon McKinney

President & Portfolio Manager

A letter from the President:

Get a Move On

My wife and I moved into a new home recently. Our children are having children, and more space was needed. Moving is not easy, but having just gone through it I would almost recommend it – it is, in some sense, a spiritual event where you find yourself examining everything you own from a margarita glass (never used) to my pleated suit pants (never to be used) to our Peloton bike (must be used!). It is a time you basically reset yourself by evaluating all the things you own and how you live your life. As I said, I don’t recommend it, but I’m glad we did it.

One thing you find with moving is that you pay a lot of fees, from realtors to movers, to lawyers and other professionals associated with the move. We paid a guy from Rogers to install TVs. There are two things to know about TVs today – you don’t take them with you and when you buy new ones, you’ll need someone to install them. Wall mounts, sound connections and just plugging them in is complicated, and well worth the almost $1,000 fee we paid.

We paid our realtor a lot, but at no time did we think we could do it ourselves. Realtors know the process and have access to buyers. We also paid a moving company because, even if we rented a truck, me and my buddies’ backs couldn’t even move our mattress (it’s big and heavy), and we paid the TV guy for tools and skills we don’t have.

“Experience is a good school. But the fees are high” – Heinrich Heine.

The cost of moving made me think about what ZLC Wealth does and the fees we charge. We don’t charge any one-off fees or commissions, but we do assess an on-going fee to assume the fiduciary role of managing our client’s assets and putting their interests first. The question is: Do clients get value for the fees they pay us?

Discount Brokers

As I sit in my office, I see what seem to be non-stop ads for discount brokers on BNN Bloomberg. The ads show graphs that compare returns with different fees and different results. All things being equal– ceteris paribus— fees do impact results. However, I would argue that all things are not ceteris paribus.

We are trained in analytics, and we certainly understand the impact small changes in returns, like fees, can make over time, but we are also well versed in the challenges individuals have in building and maintaining their own portfolios. A large study was conducted of investors that found that the average return of individual investor is just slightly better than inflation (see the graph below). This may seem surprising, but leaving aside a lack of ability many investors encounter when weighing different investment options, the general takeaway is that self-directed investors tend to invest with emotion – they invest when things are good and sell when things are bad. This “recency bias” or tendency to a “buy high, sell low” can be far more damaging to investor returns than fees.

When you ask ZLC Wealth to manage your assets, you pay two types of fees. The first fee is paid to us as your Portfolio Manager. Our fees are charged on a sliding scale: 1.1% on the first $300,000, 0.95% on the next $700,000, 0.80% between $1 and $3 million, 0.65% between $3 and $5 million, 0.50% between $5 and $10 million, and 0.45% on assets above $10 million. If you have $1 million with us you pay 1%, $2 million you pay 0.9%, $3 million its 0.87%, and so on.

The second fee is what the underlying managers charge. These fees are applied at the fund level so you don’t see them. EdgePoint charges management fees of 0.80% but the Vanguard Canadian Equity Exchange Traded Fund (ETF) only charges 0.05%. The combined cost of managers in our portfolios works out to be between 0.65% and 0.72%, depending on mix.

The overall total management cost is the combined total of our fees plus the manager and ETF fees. So, for a $1 million in assets, management cost is between 1.65% and 1.72%, $2 million is between 1.55% and 1.62% and $3 million is 1.52% and 1.59% and so on.

We pay EdgePoint for their service because we think they are worth it. Their 5-year return is 16.1%[i] (net of their fees, to March 31) and the TSX Index return for the same period is 9.9%[ii]. EdgePoint is has certainly proven to be worth their fees!

We also put a significant part of our portfolios in ETFs. These highly liquid “passive” funds give us a very low-cost way to access the Canadian bond and the Canadian, US and international equity markets. The Vanguard Canadian bonds ETF costs 0.08%, the Canadian and US equity ETFs cost 0.05%, and emerging markets costs 0.23%.

Value for Money

The value you receive from the fees we charge – fees which are comparable with most managers and banks in Canada – allow you to delegate to us the process of assessing for you available investment options (there are over 5,000 funds and 1,100 ETFs in Canada), determine the right managers (EdgePoint and Vanguard for example) and to determine the appropriate mix of different asset types – cash, fixed income, Canadian, US and global equities, alternatives such as long/short hedge funds, private equity and real estate.

We do the all the due diligence, including review of all documents and meeting with management, and we actively manage the portfolios through strategic rebalancing. In addition, our team is always here to help with your investment mechanics like tax reporting, establishing and maintaining RRSPs, Individual Pension Plans and Tax-Free Savings Accounts (TFSAs), and all the other diverse financial and administrative issues and questions our clients face.

ZLC Wealth is your fiduciary and is legally responsible for putting your interests first.

Now let’s have a look at how investments have fared over the last quarter.

Second Quarter Review

As we close out the second quarter of 2024, we find ourselves reflecting on the dynamic and ever-changing nature of the financial markets. The equity market is currently near all-time highs, making it crucial to understand the factors behind this rise and how we navigate such a landscape to uphold our fund management principles.

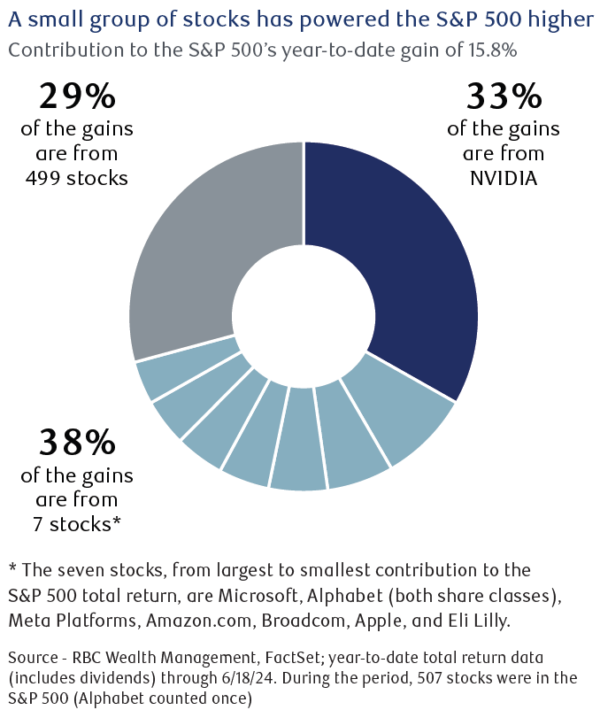

One notable trend this quarter has been the significant contribution of a small group of stocks to the S&P 500’s gains. Specifically, NVIDIA alone has accounted for 33% of the year-to-date gain of 15.8%, highlighting the concentration in the market. This growth has been driven largely by a few stocks, raising concerns among investors about concentration risks when the market retracts.

It is essential to remember that market corrections are a normal part of the financial landscape. Research from Manulife demonstrates that since 1980, the S&P 500 has experienced average intra-year drawdowns of approximately 14%, even in years with positive returns. These corrections often present opportunities to buy at lower prices, aligning with our principle of selling high and buying low.

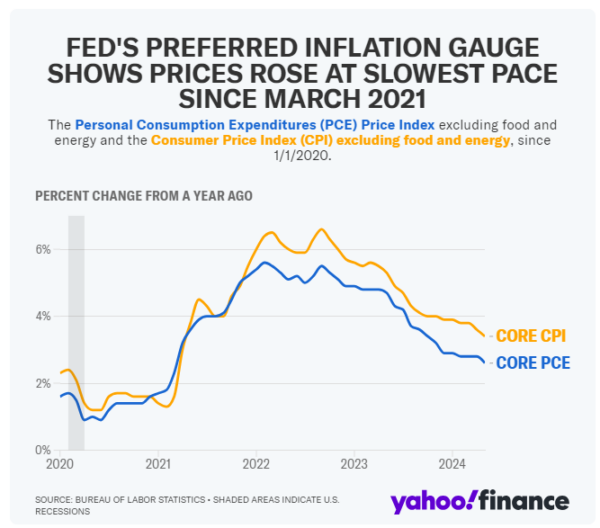

On the macroeconomic front, the U.S. has observed the slowest pace of inflation growth since March 2021. This deceleration is a positive sign, indicating that the Federal Reserve’s measures are stabilizing prices. As a result, we can anticipate a potential easing of interest rates, fostering a more favorable economic environment.

In Canada, the trend in the overnight rate and forward rates also suggests a potential reduction in interest rates. This further supports our optimistic outlook for the economy, reinforcing the importance of staying the course with diversified investment strategy to capture the full potential of the market.

In these fluctuating markets, our commitment to a diversified portfolio remains steadfast. Diversification, rebalancing, and disciplined adherence to our investment principles help mitigate risks and capitalize on opportunities. While the average investor may be tempted to chase high-performing stocks or sell in panic during corrections, our professional fund management aims to avoid these pitfalls by maintaining a balanced and forward-looking approach.

The market’s inherent unpredictability underscores the importance of diversification and professional management. Our strategic approach ensures that we are well-positioned to navigate through various market conditions, safeguarding and growing your investments over the long term.

Sources:

1. CBC/Radio Canada. (2013, January 14). Key dates in Nortel Networks’ history | CBC news. CBCnews. https://www.cbc.ca/news/business/key-dates-in-nortel-networks-history-1.802117

2. Vanguard FTSE Canadian capped REIT index ETF | VRE (n.d.). https://fund-docs.vanguard.com/VRE_FTSE_Canadian_Capped_REIT_Index_ETF_9559_FS_EN_CA.pdf

3. MSOS Factsheet. Advisorshares. (n.d.). https://advisorshares.com/wp-content/factsheet/MSOS_Factsheet.pdf?x26400

4. Wikimedia Foundation. (2024, April 17). Tulip mania. Wikipedia. https://en.wikipedia.org/wiki/Tulip_mania

5. Nvidia Corporation (NVDA) stock price, news, Quote & History – Yahoo Finance. (2024, April 18). https://finance.yahoo.com/quote/NVDA/

6. Roose, K. (2023, February 16). A conversation with Bing’s chatbot left me deeply unsettled. The New York Times. https://www.nytimes.com/2023/02/16/technology/bing-chatbot-microsoft-chatgpt.html

Disclaimer:

This newsletter is solely the work of the author for the purpose to provide information only. Although the author is a registered Investment as a Portfolio Manager at ZLC Wealth Inc. (ZLCWI), this is not an official publication of ZLCWI. The views (including any recommendations) expressed in this newsletter are those of the author alone, and are not necessarily those of ZLC Wealth Inc. The information contained in this newsletter is drawn from sources believed to be reliable, but the accuracy and completeness of the information is not guaranteed, nor in providing it does the author or ZLCWI assume any liability. This information is not to be construed as investment advice. Your own circumstances have been considered properly and that action is taken on the latest available information. This newsletter is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This information is given as of the date appearing on this newsletter, and neither the author nor ZLCWI assume any obligation to update the information or advise on further developments relating to information provided herein. This newsletter is intended for distribution in those jurisdictions where both the author and ZLCWI are registered to do business. Any distribution or dissemination of this newsletter in any other jurisdictions is prohibited. The rate of return shown is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of the Fund or returns on investment in the Fund. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the offering memorandum or prospectus of the Fund before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Performance results are not guaranteed, values may change frequently, and past performance may not be repeated.

IMPORTANT INFORMATION: The above commentary may contain an update on certain funds offered through ZLC Wealth Inc. Returns are net of fees and include reinvested dividends. The performance of the fund presented in this document may be for a different series of fund than the series that you hold in your account. The performance of the series that you hold may be different than what is shown. This information does not constitute an offer or solicitation to anyone in any jurisdiction in which such an offer or solicitation is not authorized, or to any person to whom it is unlawful to make such an offer or solicitation. These products may not be appropriate for all investors. Important information about the funds is contained in the offering documents which should be read carefully before investing. You can obtain these documents from ZLC Wealth Inc. Please speak to a ZLC Wealth Portfolio Manager or Representative to determine if these products are right for you.