A letter from the President:

Truth and Trust

We were taught early in our education the importance of truth. Pinocchio’s lies made his nose grow longer, and everyone knows Aesop’s fable about the boy who cried wolf. American schools tell their kids that their beloved first president, George Washington, when asked by his father about his prized cherry tree, could not tell a lie. Well, evidence has mounted that this story – about truth– is not actually true! It was created years later to elevate Washington’s great virtues. In the classic motion picture, The Man Who Shot Liberty Valance, we’re told that when the legend becomes the fact, print the legend. Does truth really matter, or will legend do? In the business of managing investments, legend will not do.

We read the news every day. We scan stories on BBC, Bloomberg, Reuters, or the Economist. We want updates on the war in Ukraine, the Chinese military exercises around Taiwan, the latest developments in US politics, and details on the yield curve. What is very clear to us is that the source of the news we follow is important. It’s all a matter of trust. Do we trust what the Russian media says about the number of dead soldiers in Bakhmut or their portrayal of Wall Street Journal correspondent Evan Gershkovich as a spy? Should we trust Volodymyr Zelensky’s updates about the war, keeping in mind that he is leading a country at war where legend may be more important than fact, at least to them?

You can’t mention truth without talking about Trump, who is facing 34 felony charges over the hush money and violations of campaign finance and, according to the Washington Post, has uttered 30,573 misleading or totally false claims over 4 years!1 Are Democrats better? Right-wing news sources claim possible improprieties in Hunter Biden’s dealings in the Ukraine, or so they say.

Who Do You Trust?

Media sources can be a challenge. Is Don Lemon, who CNN recently took off the air for sexist and ageist comments, too much of a left leaning big-city liberal? Is Fox and its army of right-leaning correspondents like Tucker Carlson purveyors of false commentary? And of course, there are the unregulated voices on Twitter, many of whom push nonsensical conspiracy theories. We really do need to watch who we listen to.

Trust is a particularly big issue in the US bank sector. In March, the Silicon Valley Bank was broken apart as the imbalance between their long-dated investments and liabilities became apparent. Signature Bank and Silvergate Bank failed (both had exposure to cryptocurrency), and many smaller US banks are under stress (i.e., they are experiencing significant deposit redemptions) such as at First Republic. The issue has spread out of the US, as monster bank Credit Swiss was absorbed by its even bigger Swiss countrymate, UBS. Trust is always crucial in the banking sector. Trust is still something we can count on in the much more concentrated Canadian banks industry.

Trust, in fact, may be the most important thing in investing. The roots of the investment industry hark back to the English and Scottish “trusts” of the 1870’s. Dundee Wealth (a firm I worked for which was bought by Scotiabank in 2011) was named after the Scottish city of Dundee, a town that spawned some of the first investment trusts that were precursors to the trusts, private investment pools, real estate investment trusts, or mutual fund trusts used today to manage money. These types of trusts must undergo extensive financial audits, which provides trust and are core to how assets are currently managed.

Client Safety

When you ask us to manage investments for you, an account is opened by our service provider Credential Qtrade Securities, a division of Aviso Wealth Inc. The account opening must meet the extensive legal requirements of our industry and when all t’s are crossed and i’s are dotted, and only then, will your cash be deposited in your account with our custodian Credential Qtrade Securities. Aviso Wealth Inc. is owned 50% by the Desjardins group, one of Canada’s largest financial institutions. Credential Qtrade Securities does not own your assets (you do) and you are not invested in Credential Qtrade Securities. Your assets are invested in various investments as directed by us.

Our approach in investing is to focus on what we can reliably know. We have identified and use some of the best active managers in the equity markets with strong track records over market cycles, the top experts in the fixed income (bond) market, and some of the top managers in alternative strategies, managers who give us exposure to real estate, private equity and hedged investments. We strengthen the diversity of our portfolios using low-cost index funds focused on the most efficient parts of the market, such as large cap Canadian and US equities and investment grade bonds. Finally, we ensure our client assets are held safely and are well protected.

We do not know the future and in fact we don’t think we need to know the future. We rely on the long-term appreciation of good companies, and we use fixed income and alternative strategies to protect the overall value of your portfolios. We avoid flavor of the month trends and we do rely on forecasts of the S&P, the price of gold or the value of the Canadian dollar. As investment legend John Templeton said: “In all my 55 years on Wall Street…, I was never able to say when the market would go up or down. Nor was I able to find anybody on Earth whose opinion I would value on the subject of when it would go up and down”. It can’t be known, so forget about it. Our advice: Build good portfolios and be patient.

Building portfolios is what we do. It is our core competency.

“Forecasts may tell you a great deal about the forecaster; they tell you nothing about the future.” (Warren Buffett)

In his commentary below Gareth Langdon, CFA, takes a little closer look at the current state of the market.

Jon McKinney CPA, CA, CIM®

President & Portfolio Manager

There is No Crystal Ball

In February, members of ZLC Wealth’s Investment Oversight Committee attended the 45th Annual CFA Dinner, put on by CFA Society Vancouver. It was the first time the event was held since the pandemic, and a great opportunity to engage with fellow professionals in the investment management industry. The keynote speaker for the evening was Mark Carney, currently the Chair and Head of Transition Investing for Brookfield Asset Management, but better known as the former Governor of both the Bank of Canada and the Bank of England. Mr. Carney was at the helm at the Bank of Canada during the global financial crisis, and the Bank of England during the Brexit proceedings in the UK. It’s safe to say he knows a thing or two about the economy and financial markets with the positions he has occupied. Even someone as experienced and smart as Mark Carney, cannot predict how the economy will unfold and what financial markets might do in the short term. However, he was in the camp that central banks will not be cutting interest rates this year. Will he be right?

2023 has started on a relatively positive note with both the stock and bond markets up single digits for the first quarter as markets became optimistic that global central banks might stop hiking interest rates sooner rather than later. In March there was heightened volatility amid concerns in the banking sector, but those fears have eased in recent weeks and looks to be in the rear view mirror.

I took the below screenshot earlier in the year as I found it a little ridiculous how the mainstream financial media does whatever they can to get attention and ultimately “clicks” to their website. More clicks equals more advertising money. Both headlines (written only a day apart) paint opposite scenarios and illustrates the difference of opinions out there by so called experts. Having the ability to take in and filter new information is important to avoid making investment decisions based on emotion and fear.

Future Rate Hikes, or Time to Pause?

Turning our attention yet again to the latest inflation numbers, Canadian inflation eased in January, as the Consumer Price Index (CPI) rose 5.9% from a year ago and down from 6.3% in December. February saw a continuation of inflation slowing as the CPI rose 5.2% from a year prior. This was the largest deceleration in headline inflation since April 2020. Although it is encouraging to see further reductions in inflation, there is still a ways to go before we are back to the 2% target set by central bankers.

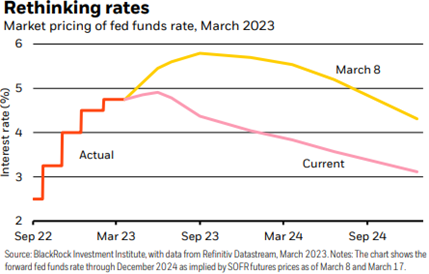

At the beginning of February, the FED raised the target for their benchmark rate by a quarter percentage point as widely expected. Over the course of February the market’s expectation of rates increasing also rose. However, due to the recent financial system stress that began in March, the expectation for the terminal rate has come down and is now back under 5%.2

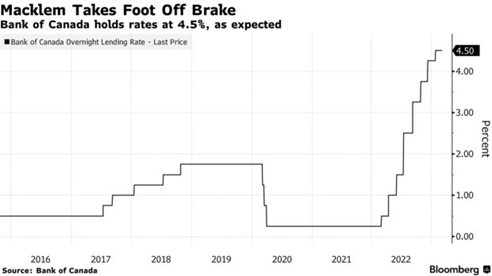

For the first time in nine meetings, the Bank of Canada didn’t hike interest rates and held the benchmark overnight rate at 4.5%. Many Canadians who have debt to service will be happy that rates didn’t go up yet again, but future rate hikes are still on the table if economic conditions warrant such hikes. The price of oil has spiked sharply in recent weeks and won’t help the case for lower inflation if it continues to go higher.

US payrolls rose in February by more than expected while a broad measure of monthly wage growth slowed. Nonfarm payrolls increased 311,000 while the unemployment rate moved slightly higher to 3.6% as the labour force grew. US payroll growth has exceeded expectations for 11 straight months, which is the longest streak in data compiled by Bloomberg back to 1998.

Near the end of March, the US central bank decided to raise interest rates by another 25 basis points. It was the ninth straight meeting they have raised rates and it was a unanimous decision, bringing the federal funds rate to a range of 4.75% to 5%. Powell emphasized in his press conference that the US banking system is sound and resilient.

Putting Cash to work

After a disappointing and frustrating 2022 for financial market returns, it’s natural to be hesitant to deploy any excess cash, rather than sit on the sidelines and earn a risk free rate, especially with the risk free rate now at more attractive levels. However, the longer you sit in cash, the lower your chances of beating the market. In fact, going back to 1928, the odds of beating the S&P 500 while sitting in cash is less than a third in a one year period. In every 25 year period, an investment in the S&P 500 has beaten cash3 This again points to that in the short term, markets can be volatile, but prudent long term investing can yield positive results.

- Gareth Langdon, CFA

UPDATE ON THE CHANGES AT ZLC WEALTH

2022 was a particularly busy year at ZLC Wealth. Most of you will have been exposed to this already, but here are some of the exciting improvements we’ve put in place to better deliver our investment management services to you:

- Quarterback software allows us to run your statements. Quarterback also gives us the flexibility us to make changes as we see ways to improve.

- Piersight is our new Client online portal that lets you access to your account holdings, ZLC Wealth quarterly statements (produce by Quarterback), and our President’s letter, all online at any time. If you want, there’ll be no more paper. E-statements will be stored securely, and accessible 24/7. Permission-based electronic delivery of reports provides you with everything you need safely and securely. If you haven’t signed on yet, email us at wealthinfo@zlc.net and we will help you.

- Evolution is our new Portfolio Management software that has allowed us to move most of our accounts to “Fee-Based” The Fee-Based program separates our management fee from the management cost of each investment. The benefits of our new Fee-Based approach are:

- Transparency, as our fees are clear and disclosed on your statements.

- Establishes an advice-based relationship that supports our fiduciary responsibilities.

- Facilitates on-going portfolio monitoring and rebalancing.

- Allows us to reduce your costs by using passive investments, such as exchange traded funds (ETF’s) in the parts of the portfolio where active stock picking rarely outperforms.

- A cascading fee schedule reduces your overall percentage fee cost as your account value increases.

- Makes our fees fully deductible for taxable accounts.

- Mako electronic forms are now up and running. Our new Mako forms allow for online signatures and Mako forms integrate with each other eliminating errors in recording and transmission.

We hope you like the changes we are making! Our goal is to keep your costs the same or lower, while continuing to provide you with the outstanding portfolio management you have come to expect from our firm.

Please send Questions or Comments

If you have questions or comments, please feel free to contact any member of the ZLC Wealth service team:

- Garry Zlotnik FCPA, FCA, CFP, CLU, ChFC, Chief Executive Officer & Portfolio Manager

- Jon McKinney CPA, CA, CIM®, President & Portfolio Manager

- Tom Suggitt CFA, CIPM, CFP, FCSI, Vice President, Portfolio Manager & Head of Investment Oversight

- Grace Domingo, Vice President Administration

- Gareth Langdon CFA, Investment Analyst

- Lisa Der, Senior Account Manager

- Mark van Koll CPA, CGA, FCSI, CAMS, Chief Compliance Officer

We’re here to help in any way we can.

Kind regards,

The ZLC Wealth Team

Sources:

1 Kessler, G., Rizzo, S., & Kelly, M. (2021, January 24). Analysis | trump’s false or misleading claims total 30,573 over 4 years. Fact Checker. Retrieved from https://www.washingtonpost.com/politics/2021/01/24/trumps-false-or-misleading-claims-total-30573-over-four-years/

2 Boivin, J. (2023, March 20). Weekly market commentary: Blackrock Investment Institute. Financial cracks show: What to do now. Retrieved from

https://www.blackrock.com/corporate/literature/market-commentary/weekly-investment-commentary-en-us-20230320-financial-cracks-show-what-to-do-now.pdf

3 Bilello, C. (2023, February 1). The Ultimate Guide to Investing Cash on the sidelines. Creative Planning. Retrieved from https://creativeplanning.com/insights/the-ultimate-guide-to-investing-cash-on-the-sidelines/

DICLAIMER: This newsletter is solely the work of the author for the purpose to provide information only. Although the author is a registered Investment as a Portfolio Manager at ZLC Wealth Inc. (ZLCWI), this is not an official publication of ZLCWI. The views (including any recommendations) expressed in this newsletter are those of the author alone, and are not necessarily those of ZLC Wealth Inc. The information contained in this newsletter is drawn from sources believed to be reliable, but the accuracy and completeness of the information is not guaranteed, nor in providing it does the author or ZLCWI assume any liability. This information is not to be construed as investment advice. Your own circumstances have been considered properly and that action is taken on the latest available information. This newsletter is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This information is given as of the date appearing on this newsletter, and neither the author nor ZLCWI assume any obligation to update the information or advise on further developments relating to information provided herein. This newsletter is intended for distribution in those jurisdictions where both the author and ZLCWI are registered to do business. Any distribution or dissemination of this newsletter in any other jurisdictions is prohibited. The rate of return shown is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of the Fund or returns on investment in the Fund. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the offering memorandum or prospectus of the Fund before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Performance results are not guaranteed, values may change frequently, and past performance may not be repeated.