Letter from the President:

Putin, the New Stalin

We begin this letter by sharing our deepest condolences to the men, women, and children lost, injured, or suffering in the maelstrom of Ukraine. We are shocked every day by the news, and we keep wondering how a brutal invasion and war can happen today, in 2022, in what should be the new age of enlightenment.

The world has changed, yet again.

I was in the Soviet Union in 1977, a high school student on a school trip to Saint Petersburg (it was Leningrad then) and Moscow. At the time, the Chairman of the Presidium of the Supreme Soviet was Leonid Brezhnev, and it was after the minor thaw of the Khrushchev period, but the Cold War was still on and, even to a 17-year-old high-school student, the struggles of communism were clear. Europe and America certainly had issues in those days, but communism made the Soviet Union feel poor, backward, and, most notably, repressed. A little over a decade later, on Christmas day in 1991, Mikhail Gorbachev shocked the world by announcing the dissolution of the Soviet Union. Communism had collapsed, the Iron Curtain fell, the wall was destroyed, and Western societies were discussing how we could spend the “Peace Dividend”, the economic benefit of reduced defense spending. Philosopher Francis Fukuyama famously declared that we had reached “the end of history”, a time when the decline of fascism and communism meant the only viable structure for society is liberal democracy.

It appears Vladimir Putin disagrees. In his view, liberal democracy was not the answer, at least not for those in power, from the Oligarchs to the state minions who enforced the rules. Putin may not have been a communist or a fascist, but he rebuilt Russia’s long history of repression. He has resurrected the “Organs” of Russian society. Ivan the Terrible used the infamous “Oprichniki” to terrorize Russia’s aristocracy in the late sixteenth century, the Tsars made use of the “Secret Department” in the seventeenth century and Peter the Great used the “Secret Chancellery”. But it was the Bolsheviks who really mastered the Organs. Their version of oppression went by a number of names, Cheka, NKVD, GPU, MGB and finally the KGB, an organization in which Putin rose to lieutenant colonel.

It is not hard to build the case that oppression is a systematic fault in Russian political culture. Nobel-winning Russian author Aleksandr Solzhenitsyn, in his monumental, exposes on the Russian culture, The Gulag Archipelago, believed that the issue for Russia is that the evildoers never faced scrutiny. The Nazis faced the Allied invasion and the courts for their war crimes, and now Germany is a strong, rich, democratic, and liberal society. The Russians missed that step and the Organ, or state police, never really disappeared and were ready and waiting for a former member, Vladimir Putin, to resurrect their rule of terror. Resurrect it he has, and now the free world is faced with the consequences, not of the will of the Russian people, but of the will of Putin and his oppressive organizations. Freedom and liberal democracy are a threat to those who control Russia and so in Putin’s mind, democracy had to be stopped, even if that means sending the army into Ukraine. Make no mistake, Russia has returned to its authoritarian past.

BETTER DAYS

RUSSIA INVADES UKRAINE

The biggest discussion in financial markets over the past month has no doubt been the Ukraine-Russia conflict and the effects the situation has and will continue to have on supply disruptions. The February invasion was the beginning of very volatile periods for financial markets and the world at large, with so much uncertainty over how the war would evolve. Initially, after the Russian attack, stocks fell sharply, and oil surged to the highest since 2014 as tensions mounted in the region. Investors reacted swiftly to the increased risk in Eastern Europe by seeking safe-haven assets such as the US dollar and gold. Crude oil (WTI) topped $130 for the first time since 2008 over concerns of Russian supply disruptions and the world shying away from wanting to buy any Russian energy products. The VIX or “fear gauge” for equity markets saw a sharp rise after the attacks but has come down over the past few weeks as the quarter came to a close.

According to The World Bank, Russia accounts for only about 2% of the global Gross Domestic Product (GDP). However, the country is a large natural gas and crude oil supplier for European markets. Together, Russia and Ukraine account for about a quarter of the world’s wheat supply. Commodity markets may continue to move higher and worsen inflation measures across the globe. There are concerns higher oil and natural gas prices will become a detractor to economic growth with higher prices deterring consumers.

PAIN AT THE PUMP

The Russian invasion of Ukraine has brought about many complicated issues and worries, but the rapid increase in oil prices deserves some special attention given its importance to the global economy. It wasn’t too long ago that oil was trading at minus $40 during the height of the pandemic, and now here we are with oil hovering around $100 a barrel at the time of writing. Here in Vancouver, we’ve seen record gas prices as the price went over the eye-popping two-dollar mark (and then some) for the first time in the province’s history.

In the last quarterly letter we briefly examined how Canada’s economy is set up to deal better with higher inflation and commodity prices than our southern neighbour. This is partially reflected in the relative outperformance of the S&P/TSX versus the S&P 500 over the past three months as the S&P/TSX Composite Index gained 3.1%, outperforming the S&P 500 by more than 8 percentage points which is the most in 13 years.

ON YOUR MARK, GET SET… HIKE!

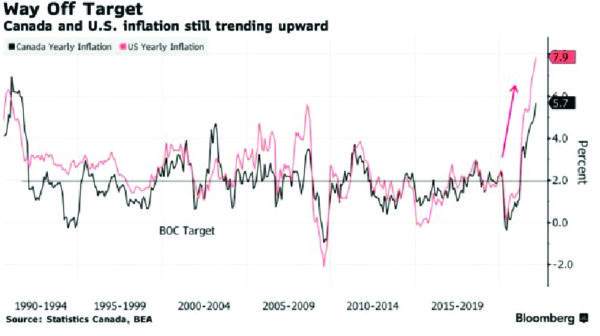

After so much speculation over the past few months of when Canada and the U.S. would increase interest rates, we finally can put that question to rest; both the Federal Reserve in the U.S. and the Bank of Canada raised rates by a quarter percentage point in March and signaled more hikes would be coming to try and wrestle down inflation. Federal Reserve Chair Jerome Powell recently said the central bank is prepared to raise interest rates by a half percentage-point at its next meeting if needed, deploying a more aggressive tone toward curbing inflation than he used at the March meeting. Europe is also dealing with inflation pressures with headline CPI moving to 7.5% year over year in March. It wasn’t that long ago when central banks around the world were slashing interest rates during the pandemic and now, here we are with the expectation of multiple rate hikes over the course of 2022.

WHAT’S NEXT?

Financial markets have been very headline-reactive in recent weeks, moving on the back of whatever the latest development might be with the Ukraine-Russia conflict which has added to the volatility we have experienced and may continue in the near term. The recent spike in food and energy prices may take a toll on the spending habits of consumers, despite the low unemployment rate and strong balance sheets of both consumers and corporations. Paul Donovan, the chief economist at UBS Global Wealth Management highlighted in a note that “because food is a necessity, higher food prices will lead to changing developed economy consumption patterns. More money spent on food, within a constrained budget, means less money to spend on other goods (or services). The goods demand slowdown is likely to be modest, but it comes at a time when global goods supply is at a record high.” Inflation is outpacing wage growth and has started to dent consumer demand, with U.S. consumer spending declining in February. Time will tell what reduction in spending might materialize because of higher prices, and when inflation may eventually subside closer to the 2% level targeted by many central banks. Interest rates are expected to rise and how strongly that will change the economy is the big question. Even with the recent inflation spike in the U.S., consumer confidence increased in March after a downward reading in February, which was the lowest in a year. While the ongoing situation with Ukraine and Russia plays out one way or the other, global financial markets will continue to be forward-looking and react to future expectations.

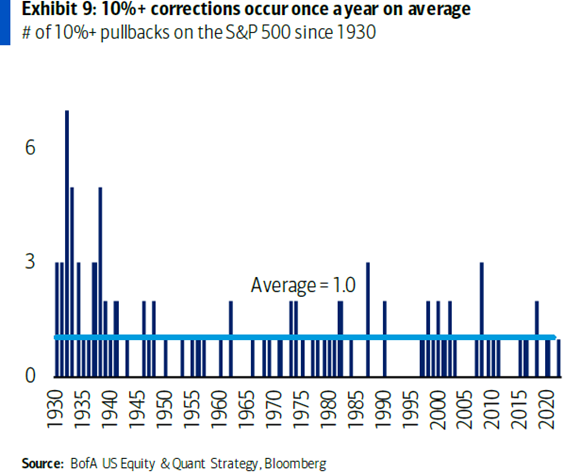

On a final note, it’s important to mention that although 10% corrections in equity markets are never a pleasant experience, it helps to know that on average they occur once a year and are more common than many investors think. At the time of wring in early April, the main indexes have shown great resilience and had surpassed their levels before the Russian invasion of Ukraine.